If you're in India and thinking about moving your crypto assets overseas, you need to know this: it's not just a technical move. It's a legal minefield. The Indian government has built a web of rules so tight that even small transfers can trigger audits, fines, or worse. And it's not about stopping crypto-it's about controlling it. Every step you take outside India’s borders now leaves a digital trail the tax authorities are watching closely.

What Happens When You Send Crypto Out of India?

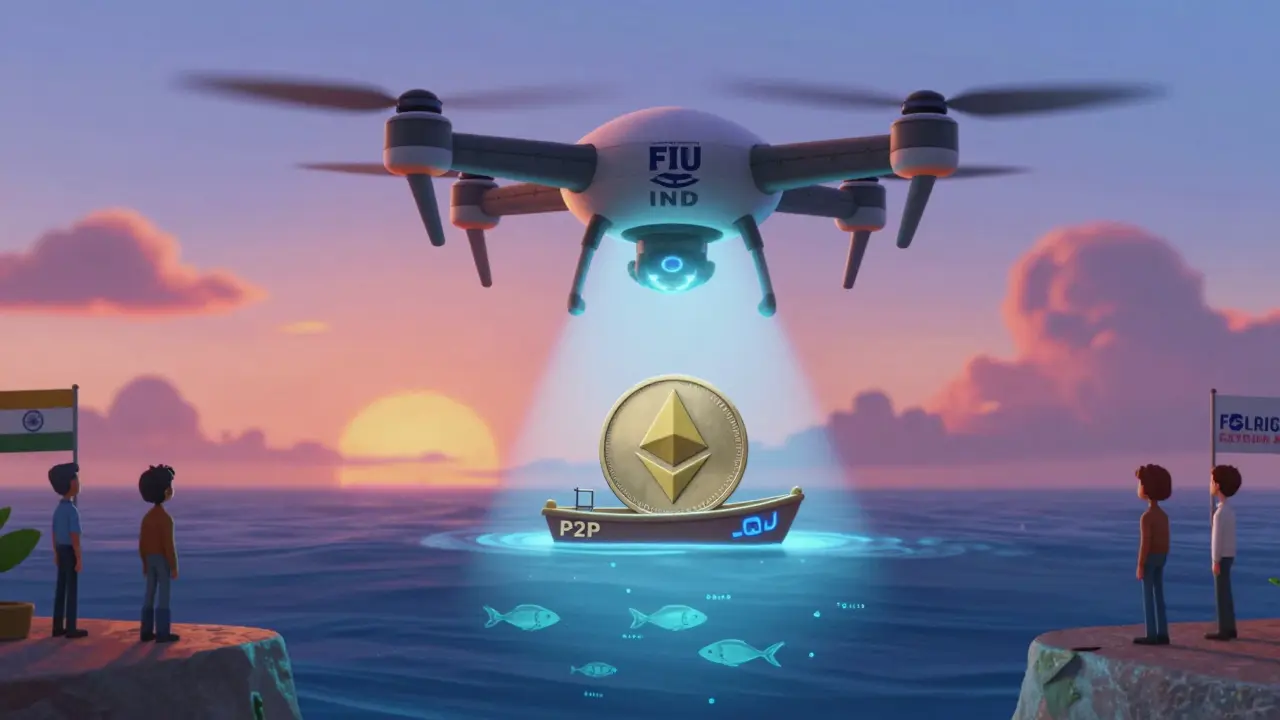

Sending Bitcoin, Ethereum, or any other crypto from an Indian wallet to an exchange in the U.S., Singapore, or UAE isn't treated like sending money to a friend. Under India’s 2025 rules, it’s classified as a Virtual Digital Asset (VDA) transfer under the Income Tax Act. That means it’s subject to strict reporting, heavy taxes, and mandatory disclosures you can’t ignore. The Reserve Bank of India (RBI) treats these transfers as current account transactions under the Foreign Exchange Management Act (FEMA). That’s unusual-most countries classify crypto as capital assets. But in India, even if you’re just moving your own coins to a personal wallet abroad, you’re still under financial surveillance. You can’t bypass this by using peer-to-peer (P2P) platforms like LocalBitcoins or Paxful. The Financial Intelligence Unit-India (FIU-IND) now requires all crypto exchanges serving Indian users-whether based in India or overseas-to report every transaction. That includes Binance, Bybit, and KuCoin. If you’re an Indian resident, your activity is tracked regardless of where the exchange is headquartered.The 30% Tax That Doesn’t Care About Losses

Here’s the kicker: India taxes crypto profits at a flat 30%. No deductions. No loss offsets. If you bought Bitcoin for ₹5 lakh and sold it for ₹8 lakh, you owe ₹90,000 in taxes-even if you lost ₹2 lakh on another trade that same year. This rule applies whether you’re selling inside India or moving the asset abroad. On top of that, a 1% Tax Deducted at Source (TDS) kicks in on every transaction over ₹50,000 in a financial year. So if you transfer 0.5 BTC worth ₹3 lakh to a foreign wallet, ₹3,000 gets automatically withheld as tax. And if you’re using a local exchange like WazirX or CoinDCX to send crypto out, they’ll deduct it before the transfer even goes through. Worse, some exchanges now add an 18% Goods and Services Tax (GST) on withdrawals, staking, and even margin trades. That’s not just tax on profit-it’s tax on the movement itself. You’re paying tax just for changing wallets.You Must Disclose Foreign Crypto Holdings

The Income Tax Department doesn’t just want to know what you earned-they want to know where it is. All Indian residents must declare foreign crypto holdings in Schedule VDA of their ITR-2 or ITR-3 tax returns. This isn’t optional. Failing to report means you’re subject to a 60% penalty on the undisclosed value under Section 158B of the Income Tax Act. Let’s say you moved 10 ETH worth ₹25 lakh to a wallet in Singapore and didn’t report it. If the tax department finds out, you could owe ₹15 lakh in penalties alone-not even counting the original 30% tax. And this isn’t theoretical. In 2025, the CBDT sent out over 12,000 notices to individuals suspected of undeclared crypto holdings abroad. The valuation rules are strict too. You must report the value of your crypto in Indian Rupees at the exact time of transfer, using the RBI’s published exchange rate. If you transferred on a Friday and the rate changed by Monday, you can’t use the Monday rate. The system records the timestamp of the blockchain transaction and matches it to the RBI’s daily rate.

FEMA Limits: The 0,000 Cap

Under FEMA regulations, Indian residents need prior approval from an authorized dealer bank (like HDFC or ICICI) to send more than $250,000 in crypto abroad per year. This applies to all virtual assets treated as “intangible movable property.” That limit isn’t just a suggestion. In June 2025, the Enforcement Directorate froze accounts of three Indian traders who tried to move $310,000 in crypto without approval. One of them had split the transfer across three wallets to avoid detection. It didn’t work. Blockchain analytics firms like Chainalysis flagged the pattern, and the FIU-IND traced all transactions back to the same PAN. Even if you’re under the limit, you still need to maintain records: wallet addresses, timestamps, exchange statements, and proof of origin. The RBI’s KYC 2025 directive requires exchanges to keep these for at least five years-and hand them over on request.The Travel Rule: No Minimum, No Exceptions

India is the only country in the world that applies the FATF Travel Rule to every crypto transaction, no matter how small. In most places, you only need to share sender and receiver details if the transfer is over $1,000. In India, even sending ₹100 worth of Dogecoin to a friend overseas triggers full disclosure. Exchanges must collect and transmit:- Full legal name

- Physical address or date of birth

- Account number or wallet ID

- National ID number (PAN or Aadhaar)

What Happens If You Get Caught?

The penalties aren’t just financial-they’re personal. The Enforcement Directorate has started linking crypto violations to money laundering cases under the Prevention of Money Laundering Act (PMLA). That means:- Accounts can be frozen without warning

- Assets can be seized

- Criminal prosecution is possible for repeat or large-scale violations

Who’s Affected the Most?

It’s not just traders. Investors, miners, and even NFT collectors are caught in this net. If you hold NFTs bought with crypto and later transfer them abroad, they’re now classified as VDAs. That means they’re taxable. That means they’re reportable. That means they’re traceable. The data shows it’s working-for the government, at least. Cross-border crypto outflows from India dropped 32% in the first half of 2025, while global volumes rose 15%. But the real story is underground: P2P trading volume jumped 28% as users turned to cash-based, in-person trades to avoid detection. Experts warn this isn’t sustainable. Dr. Rajeshree Agarwal of the National Institute of Public Finance and Policy says India’s system-30% tax + 1% TDS + 18% GST + 60% penalty-creates an effective tax burden of over 50% on many transactions. That’s higher than Nigeria or Pakistan.What Should You Do Now?

If you’re thinking of moving crypto out of India:- Calculate your total crypto value across all wallets. Include staking rewards and NFTs.

- Use the RBI’s historical exchange rates to value each transfer at the exact time it happened.

- File Schedule VDA in your ITR before the July 31 deadline.

- If transferring over $250,000, contact your bank’s authorized dealer for FEMA approval-start early, it takes weeks.

- Only use exchanges registered with FIU-IND. Check the official list on the FIU-IND website.

- Keep records of every transaction: screenshots, transaction IDs, wallet addresses, and exchange confirmations.

What’s Next?

The government plans to introduce comprehensive crypto legislation in the Winter Session of Parliament 2025. But Finance Minister Nirmala Sitharaman has made it clear: crypto won’t become legal tender. The goal isn’t to ban it-it’s to control it, tax it, and monitor it. The next big change? India is preparing to join the Crypto-Asset Reporting Framework (CARF), which will automatically share crypto transaction data with over 100 countries. By 2026, your foreign holdings won’t just be reported-they’ll be known. The message is simple: if you move crypto out of India, the government will know. And they’ll expect you to pay.Can I move crypto abroad without paying tax in India?

No. India taxes crypto gains at 30% regardless of where the asset is held. Even if you transfer crypto to a wallet overseas, the gain realized at the time of transfer is taxable. Failure to report can lead to a 60% penalty on the undisclosed value, plus criminal prosecution under Section 158B of the Income Tax Act.

Is there a limit to how much crypto I can send abroad?

Yes. Under FEMA, Indian residents need prior approval from an authorized dealer bank to send more than $250,000 worth of crypto abroad in a single financial year. This applies to all Virtual Digital Assets treated as intangible movable property. Exceeding this limit without approval can lead to account freezes and enforcement action.

Do I need to report crypto held in foreign wallets?

Yes. All Indian residents must declare foreign crypto holdings in Schedule VDA of their ITR-2 or ITR-3 tax returns. This includes wallets on exchanges like Coinbase, Binance, or self-custody wallets abroad. Non-disclosure triggers a 60% penalty on the undisclosed value and possible criminal charges.

Can I use a non-Indian exchange to avoid Indian taxes?

No. Any exchange serving Indian users-even if based overseas-must comply with Indian KYC and reporting rules. Platforms like Binance and Bybit are required to share transaction data with FIU-IND. If you’re an Indian resident, your activity is tracked regardless of the exchange’s location.

What happens if I don’t report my crypto transfers?

You risk a 60% penalty on the value of undeclared crypto assets, along with potential criminal prosecution under the Prevention of Money Laundering Act. The Enforcement Directorate has already frozen accounts and seized assets in multiple cases. Blockchain analytics tools make it nearly impossible to hide cross-border transfers.

Comments

The Indian regulatory framework surrounding Virtual Digital Assets is nothing short of a masterclass in overreach. The conflation of VDA transfers with current account transactions under FEMA is a legal fiction of the highest order. When you classify digital property as currency, you invalidate the very notion of asset ownership. The 30% flat tax without loss offset is economically irrational-it penalizes volatility, not profit. And the 18% GST on withdrawals? That’s not taxation; it’s a transactional toll road. The FIU-IND’s demand for full KYC on every micro-transfer violates the principle of proportionality. This isn’t regulation-it’s surveillance capitalism dressed in regulatory robes. The government’s obsession with control has turned crypto from innovation into a compliance nightmare. The real losers? The middle-class investor who simply wants to hedge against rupee depreciation. The system is rigged to serve bureaucrats, not citizens.

i just want to say… i live in the us and honestly? this feels so extreme. like, i get taxes, i get reporting, but paying tax just for MOVING coins?? and a 60% penalty for forgetting to check a box?? 😭 i dont even know how people sleep at night with all this. i feel bad for indians trying to hold crypto. its like the gov is trying to stop the future with a paperclip.

Reading this made me feel so tired. I know people are trying to protect their assets, but the way this is set up… it feels like the system is designed to make you fail. Like, you’re not even allowed to make a mistake. One wrong timestamp, one unreported NFT, and boom-you’re in trouble. I just wish there was more compassion in policy. Not everyone who holds crypto is trying to hide money. Some of us just believe in decentralization. And now we’re being treated like criminals for having beliefs.

so like… if i send 1 doge to my bro in singapore… they really track that?? 😅 i mean… its 1 doge. not even 2 bucks. why do i feel like im being watched by a robot army??

This is just government overkill. Why not just let people do what they want? If someone wants to move crypto, let them. Tax it properly, sure. But don’t freeze accounts and demand documents for every tiny transfer. People are trying to protect their wealth. This isn’t crime-it’s survival.

30% tax + 1% TDS + 18% GST = 49% total tax on movement?? 😳 and they wonder why people use p2p? bro, this isn’t regulation, this is extortion with paperwork. i’m out.

i think the real issue is not the tax but the fear. why do we have to prove we’re not criminals just to move our own money? the system assumes guilt before innocence. and now every exchange is a spy. i just want to hold my coins in peace

As someone who has lived through multiple economic shifts in India, I find this regulatory architecture deeply concerning. The emphasis on compliance over clarity creates a chilling effect on innovation. The mandatory disclosure of foreign wallet holdings, while ostensibly transparent, effectively criminalizes financial autonomy. The RBI’s alignment with FATF’s Travel Rule for all transactions-regardless of value-is a precedent-setting overreach. The government’s intent may be fiscal control, but the outcome is a loss of trust. People are not resisting taxation-they are resisting surveillance masquerading as policy. We must ask: who benefits from this level of intrusion? And at what cost to individual liberty?

Look, I get it-taxes need to be collected. But this isn’t taxation, it’s a full-on crypto lockdown. You’re not stopping people from moving assets-you’re just forcing them underground. P2P trading is surging because the system is broken. Instead of building walls, build bridges. Create a clear, simple framework. Make compliance easy. Reward transparency. You want people to pay taxes? Make it painless. Don’t turn every transfer into a legal audit. This isn’t smart policy-it’s self-sabotage.

The irony is breathtaking. India is positioning itself as a global fintech leader, yet it is implementing the most draconian crypto regime on the planet. The 60% penalty for non-disclosure is not a deterrent-it’s a punishment for honesty. The Travel Rule applied universally? No other jurisdiction does this. This is not innovation-it is isolation. The global market is moving toward interoperability, transparency, and smart regulation. India is building a digital fortress with barbed wire. The cost? Brain drain. Capital flight. And the erosion of trust in institutions. This is not a victory for fiscal policy. It is a defeat for progress.

Let me be blunt: this is the reason America is the last bastion of financial freedom. You people are letting bureaucrats turn your own currency into a prison. 30% tax? Fine. But 18% GST on withdrawals? That’s theft. And the fact that you’re reporting every tiny transfer to FIU-IND? That’s not regulation-that’s totalitarianism. I don’t care if you’re ‘protecting the economy.’ This is the kind of policy that makes people leave. And when they leave, they take their talent, their innovation, their future. You’re not controlling crypto-you’re killing your own economic potential.

I’ve been in crypto since 2017, and I’ve seen governments panic. But India’s approach? It’s the most thoughtful overreaction I’ve ever seen. You’re not making crypto safer-you’re making it scarier. People aren’t trying to evade taxes-they’re trying to survive inflation. If you want them to comply, make the system work for them. Offer tax credits for reporting. Create a simple portal. Stop treating every user like a money launderer. This isn’t about enforcement-it’s about empathy. And right now, there’s none to be found.

bro… 1% TDS + 30% tax + 18% gst = 49% 😭 i just wanted to move my eth to a cold wallet in canada… now i feel like i’m smuggling nukes 🥲

you know what’s wild? the fact that people are still trying to make this work. i’ve seen indians on forums, late at night, calculating exact timestamps and RBI rates like they’re doing rocket science. that’s not criminal behavior-that’s dedication. and instead of celebrating that grit, the system is smothering it with red tape. you’re not fighting crypto-you’re fighting your own people. and that’s the saddest part.

There’s a deeper philosophical question here: Should financial sovereignty be a right or a privilege? If we treat crypto as property, then moving it across borders should be as natural as moving a painting or a book. But when we impose layers of reporting, taxation, and surveillance on every single transaction-no matter how small-we are saying that the state owns your assets more than you do. This isn’t about revenue. It’s about control. And control, when applied without consent, erodes the very foundation of trust between citizens and institutions. The real risk isn’t tax evasion-it’s the collapse of faith in governance itself.