HashKey Global Fee Calculator

Calculate your monthly trading fees on HashKey Global based on your trading volume. See how much you could save by reaching VIP status.

Results

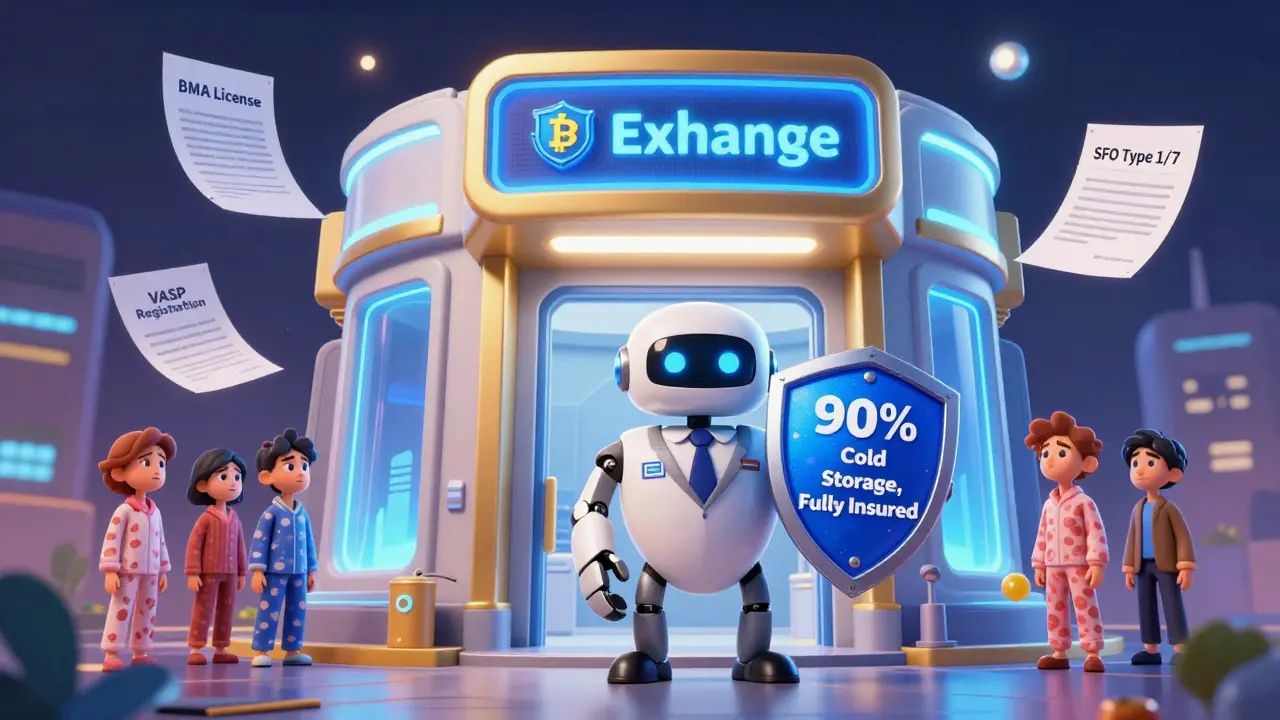

When you’re looking for a crypto exchange that actually follows the rules, HashKey Global stands out - not because it has the most coins, but because it’s one of the few that got licensed properly. Most exchanges operate in the gray zone. HashKey Global? It’s got licenses from Bermuda, Hong Kong, and more. That’s not marketing fluff. That’s legal paperwork you can verify.

Who Regulates HashKey Global?

HashKey Global isn’t just another platform claiming to be "secure." It’s regulated by the Bermuda Monetary Authority (BMA) with a Class F Digital Asset Business License - the same one Coinbase International got. Only two exchanges in the world hold this. It’s also licensed under Hong Kong’s Securities and Futures Ordinance as a Type 1 and Type 7 provider, meaning it’s legally allowed to trade securities and run automated trading systems. Plus, it’s registered as a Virtual Asset Service Provider (VASP) under Hong Kong’s Anti-Money Laundering laws.

This isn’t common. In 2025, over 70% of crypto exchanges still operate without any formal regulatory approval. HashKey’s compliance isn’t optional - it’s baked into its structure. That’s why Forbes named it the "Most Trusted Cryptocurrency Exchange in the World" for the third year in a row. Their evaluation looked at 200+ platforms and scored them on nine factors: transparency, audit strength, regulatory compliance, trading volume, and more. HashKey ranked 14th globally on that list - the only Hong Kong-based exchange to make the cut.

Trading Pairs, Fees, and Minimum Deposits

HashKey Global offers 107 spot trading pairs and 53 futures pairs with up to 1:10 leverage. You can trade major coins like BTC, ETH, SOL, and ADA, plus dozens of smaller tokens. The platform supports USD and HKD deposits and withdrawals, which is rare for a global exchange. Most require you to convert to crypto first. Here, you can deposit fiat directly via bank transfer or card.

Fees start at 0.0% for VIP users. Yes, you read that right - zero fees. The VIP program has nine levels, from VIP 0 to VIP 9. To get there, you need to trade more volume. Even if you’re new, you start at VIP 0 with a standard 0.1% trading fee. The minimum deposit? Just $1 or 0.0005 BTC. That’s lower than most exchanges. You can start with less than the cost of a coffee.

Minimum trade size for futures is 1 USDT. That’s small enough for casual traders but still allows for precise position sizing. Order types include limit, market, stop-limit, and trailing stop. There’s no hidden fee structure. Everything is listed clearly on their website.

Security: Cold Storage, Insurance, and Audits

HashKey stores 90% of user funds in cold wallets - offline, air-gapped, and protected with military-grade encryption. The remaining 10% in hot wallets are fully insured at no extra cost to you. That’s not a gimmick. It’s a guarantee backed by third-party insurers. Most exchanges don’t offer this. Some charge you extra for insurance. HashKey includes it.

The exchange has been audited by Big 4 accounting firms - the same ones that audit banks and public companies. These aren’t superficial checks. They look at financial records, security protocols, and how client funds are segregated from company assets. They confirmed that HashKey doesn’t use customer deposits to fund operations. That’s a huge red flag on unregulated platforms.

Two-factor authentication (2FA) is mandatory. All data is encrypted with SSL. Client accounts are segregated - meaning your funds can’t be touched if the company runs into trouble. These aren’t just features. They’re industry standards for institutional-grade platforms.

What Users Say - The Contradiction

Here’s the problem: HashKey Global has two very different reputations.

On one side, Forbes, CoinGecko, and institutional investors praise it. CoinGecko ranked it 7th globally in early 2025 - the highest-ranked regulated exchange. It’s used by hedge funds, market makers, and asset managers. Its partnership with B2C2, a top institutional liquidity provider owned by Japan’s SBI Group, shows real trust from Wall Street-style players.

On the other side, Traders Union gave it a 1.94 out of 10. They call it high-risk. Why? Client complaints. Users report slow withdrawals, unresponsive support, and confusing interface updates. Some say customer service takes days to reply. Others say the mobile app crashes during high volatility.

There’s no official Trustpilot or Reddit thread volume to confirm these claims, but the pattern is clear: institutions love it. Retail users? Some are frustrated. It’s not a scam. It’s not a Ponzi. But it’s not built for beginners who want hand-holding.

Who Is This Exchange For?

HashKey Global is not the best pick if you’re new to crypto and just want to buy Bitcoin and hold it. You’ll find simpler apps like Coinbase or Kraken easier to use.

But if you’re:

- Trading futures or derivatives regularly

- Depositing USD or HKD directly

- Wanting institutional-grade security

- Trading over $10,000/month

- Worried about exchanges freezing funds or going dark

- then HashKey Global is one of the safest bets in 2025.

It’s not flashy. No meme coin listings. No gamified rewards. No influencer marketing. Just clean, regulated, audited trading. If you care about where your money is stored and who’s watching over it, this is the platform that actually answers those questions.

Geographic Restrictions and Support

HashKey Global doesn’t serve users in the USA, China, or Hong Kong. That’s not a bug - it’s a feature. Those are high-regulation zones where crypto exchanges face legal risk. By excluding them, HashKey avoids regulatory clashes and keeps its licenses intact.

Support is available 24/7 via live chat, but ticket responses are limited to 8 AM to 6 PM (UTC+8). That’s a problem if you’re in Europe or the Americas and need help outside those hours. Email support works, but don’t expect instant replies. Language support includes English, Chinese, and Japanese - no Spanish or French.

The mobile app is available on iOS and Android. It’s functional, not beautiful. It doesn’t have fancy charts or social feeds. It’s built for traders who want speed, not entertainment.

Final Verdict: Trust, But Verify

HashKey Global is not perfect. But it’s one of the few crypto exchanges you can trust to still be around in 2026. It doesn’t promise moonshots. It doesn’t hype NFTs. It doesn’t gamble with your money.

It’s a regulated, audited, insured platform that prioritizes compliance over hype. If you’re serious about trading crypto without risking your funds to an unlicensed operator, this is one of the few options that actually delivers on security.

Just know this: if you need 24/7 live support or a super-simple interface, look elsewhere. But if you want a platform that plays by the rules - and has the paperwork to prove it - HashKey Global is worth your attention.

Comments

Honestly, this is the kind of exchange I’ve been waiting for. No hype, no meme coins, just clean compliance. I’ve had funds frozen on other platforms. This one feels like it’s built to last.

The fact that they use Big 4 auditors and segregate client funds is non-negotiable for institutional use. Most retail traders don’t even know what segregation means. This is the baseline for any serious platform.

Lol so they’re regulated… by Bermuda? That’s like getting a driver’s license from a tropical island that doesn’t even have traffic lights. Next they’ll say their cold wallets are guarded by sea turtles.

Zero fees? Yeah right. There’s always a catch. Probably hidden in the 37-page TOS no one reads. Also, why is the mobile app so ugly? If you’re targeting pros, at least make it not look like it was coded in 2015.

If you’re not from the US you’re basically a second-class citizen on this platform. And they call themselves global? LOL. They’re just avoiding the regulators that actually matter.

The real innovation here isn’t the trading pairs or the fee structure-it’s the philosophical commitment to institutional integrity over retail spectacle. We’ve normalized gambling disguised as finance. HashKey refuses to participate. That’s revolutionary.

The VASP compliance + BMA Class F license is a game-changer. It’s not just about KYC-it’s about systemic trust architecture. This is what DeFi needs to graduate from the Wild West. 👏

I’m not impressed. If you’re trading under $10k/month, you’re wasting your time here. The interface is clunky, support is a joke, and the whole thing feels like a boutique bank for hedge funds that forgot to invite the rest of us.

It’s funny how people scream about regulation being boring… until their funds vanish. Maybe we need more platforms that care about being around next year, not just trending on Twitter today. 🌱

The paradox of trust: the more rigorously a system is designed to prevent failure, the less it attracts those who thrive on chaos. HashKey is a cathedral in a carnival. Beautiful. Silent. Alone.

I appreciate the transparency, but the 8 AM–6 PM UTC+8 support window is unacceptable for a global platform. If you serve Europe and the Americas, you need to staff accordingly. This isn’t 2017 anymore.

You think slow withdrawals are bad? Try getting a response from Coinbase support after a $50k trade. At least HashKey has a paper trail. Most others don’t even have receipts.

Oh wow, a crypto exchange that doesn’t have a ‘Buy Dogecoin & Get a Free NFT’ button? How dare they? 🙄 Next they’ll tell us to actually read the whitepaper. The horror.

Bermuda? Hong Kong? LOL. All of it’s just a front. They’re just hiding behind paperwork while quietly selling your data to the NSA. You think they care about compliance? They care about staying off the radar.

I don’t care how many licenses they have. If the mobile app crashes during a pump, it’s useless. Security means nothing if you can’t execute a trade when you need to.