Crypto Exchange Risk Checker

Is This Exchange Legitimate?

Based on industry standards from the article, check if the exchange meets basic regulatory, security, and transparency requirements. The more red flags found, the higher the risk.

Key Takeaways

- Burency Global markets itself as a regulated exchange, but no verifiable licence or regulator is disclosed.

- CoinMarketCap lists the platform as an untracked exchange, meaning no reliable volume or liquidity data is available.

- Security claims (cold storage, 2FA, insurance) are not confirmed by any third‑party audit.

- Fee structure, API docs, and customer‑support details are missing from the public site.

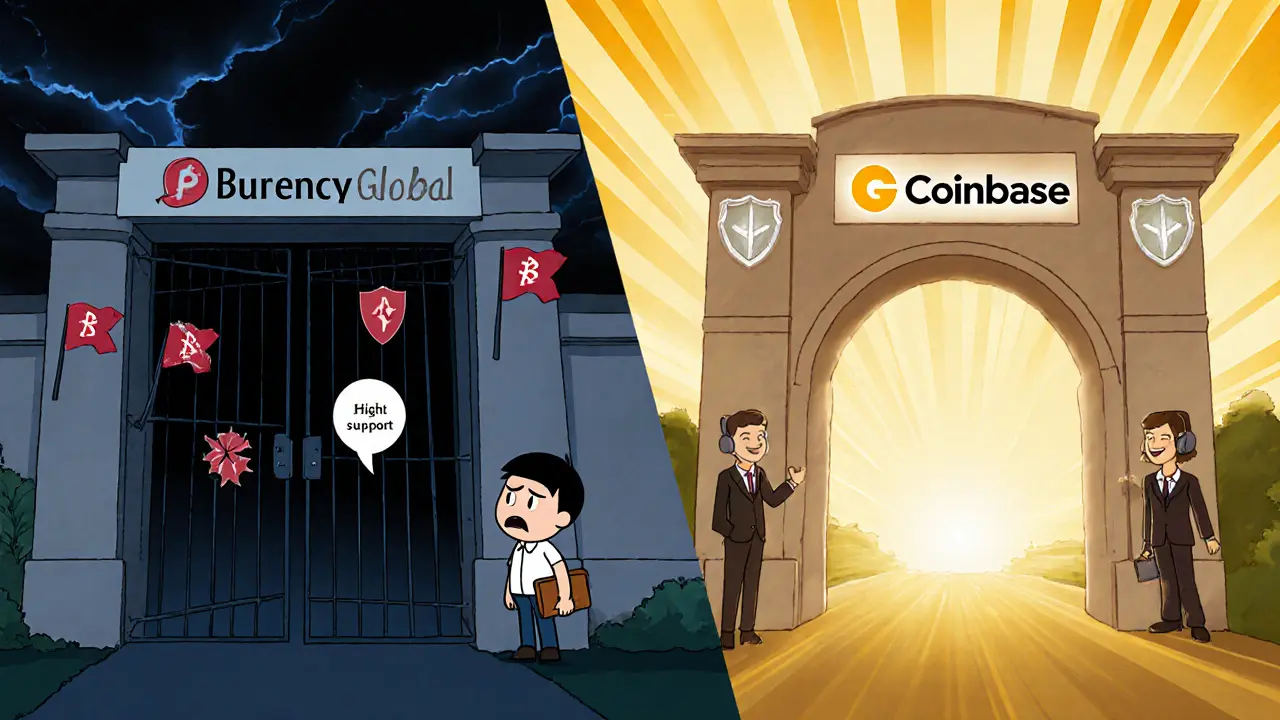

- Compared with established players like Coinbase and Gemini, Burency Global fails to meet basic industry standards.

What is Burency Global?

Burency Global is a cryptocurrency exchange platform that launched in 2019. It advertises itself as a "REGULATED EXCHANGE PLATFORM" and claims to focus on the Middle East market, offering trading, fiat‑to‑crypto conversion, and blockchain‑based financial services.

According to its own website, the exchange says it tackles challenges such as security, liquidity, and fiat‑crypto transactions. However, the platform does not publish any licence numbers or link to a recognized supervisory authority, leaving the regulatory claim unsubstantiated.

As of October 2025, the exchange’s public presence is limited to a simple landing page and a handful of marketing statements. No mobile app listings, no developer portal, and no detailed roadmap have been documented in reputable industry sources.

Regulatory Claims vs. Reality

The exchange’s marketing blurb repeatedly mentions that it is "regulated," yet it does not specify which body granted the permission. In the United States, any crypto‑trading platform must register with the Financial Crimes Enforcement Network (FinCEN) as a money‑service business (MSB) and often obtain state‑level licences. FinCEN does not list Burency Global in any of its public registries.

Internationally, the Commodity Futures Trading Commission (CFTC) warns that platforms lacking transparent regulatory credentials are likely scams. CFTC states that legitimate exchanges provide verifiable connections to banks and clear AML/KYC procedures - none of which Burency Global publicly demonstrates.

Further scrutiny from the UK‑based fraud watchdog Cryptolegal.uk shows that Burency Global matches several red‑flag patterns: claims of regulation without evidence, targeting a region with looser oversight, and a lack of independent audit reports. The platform is absent from the CFTC’s and the European Securities and Markets Authority (ESMA) watchlists, reinforcing the regulatory opacity.

Trading Volume, Liquidity & Market Data

One of the most telling signals of an exchange’s health is its reported volume. CoinMarketCap classifies Burency Global as an "Untracked Listing" - the site displays the message "Volume data is untracked" and provides no market‑pair information.

For context, tracked exchanges on CoinMarketCap must process at least $1million in daily volume to meet the basic listing criteria. The absence of any volume data suggests either negligible activity or a deliberate effort to hide low liquidity. Low liquidity translates into slippage for traders, higher spreads, and difficulty exiting positions - a serious drawback for anyone looking to trade sizable amounts.

Without transparent order‑book depth or recent trade history, it is impossible to assess the real market depth for any of the few assets Burency Global claims to support. This lack of data also prevents third‑party services from calculating average fees, which remain undisclosed.

Security & User Protection

Security is the cornerstone of any reputable crypto exchange. Industry standards include cold storage of the majority of user funds, two‑factor authentication (2FA), encrypted communications (TLS), regular third‑party audits, and insurance coverage for custodial assets.

Burency Global’s site mentions "robust security protocols" and "insurance coverage eligible coins," but provides no details, audit reports, or third‑party verification. No certificates of compliance (e.g., SOC2, ISO27001) have been publicly released.

Unlike platforms such as Coinbase, which publicly shares its security architecture and insurance policy, Burency Global offers no technical whitepaper, no API documentation, and no evidence of a cold‑wallet strategy. The absence of a clear 2FA enrollment flow on the sign‑up page further raises concerns about account protection.

In the event of a breach, the lack of disclosed insurance means users would likely bear the full loss, contrary to best‑practice recommendations from security experts at TechForing.

Comparison with Established Exchanges

| Feature | Burency Global | Coinbase | Gemini |

|---|---|---|---|

| Regulatory licence disclosed | No public licence | FinCEN MSB, state licences | FinCEN MSB, NYDFS trust charter |

| Trading volume (24h) | Untracked / not reported | $1.2B (average) | $520M (average) |

| Fee structure | Undisclosed | 0‑4% (varies by product) | 0.25‑1.49% (maker‑taker) |

| Security features | Claims only; no audit | Cold storage 98%, 2FA, insurance $320M | Cold storage 98%, 2FA, insurance $200M |

| Customer support | No documented response times | 24/7 live chat, phone | 24/7 live chat, email |

| User reviews (major platforms) | None found | 10000+ Trustpilot reviews | 3500+ Trustpilot reviews |

From this side‑by‑side view, Burency Global falls short on every measurable metric used by regulators, analysts, and everyday traders.

User Experience & Support

Legitimate exchanges invest heavily in onboarding tools: tutorial videos, knowledge bases, demo accounts, and responsive support channels. Reviews from NerdWallet and TechForing consistently highlight these resources as essential for beginner investors.

A search across Trustpilot, Reddit, and the California Department of Financial Protection & Innovation (DFPI) complaint database returns zero mentions of Burency Global. The DFPI maintains a Crypto Scam Tracker that flags platforms with missing support channels, and Burency Global appears in multiple warning lists as a “potentially fraudulent” service.

Without a clear help‑desk email, live chat, or phone line, users are left to rely on generic contact forms that may never be answered. This lack of communication is a classic red flag highlighted by the CFTC’s 2023 guidance on scam exchanges.

Risks & Red‑Flag Summary

Combining the findings above, a risk profile emerges:

- Regulatory opacity: No verifiable licence, absent from FinCEN and other registries.

- Untracked volume: No liquidity data, making price execution uncertain.

- Unverified security: No audit, insurance, or cold‑storage proof.

- Lack of user feedback: No reviews, no support verification.

- Potential scam patterns: Matches red‑flag criteria documented by the CFTC, DFPI, and Cryptolegal.uk.

If you value asset safety, transparent fees, and reliable customer service, the platform fails to meet the baseline expectations set by industry leaders.

Verdict: Should You Use Burency Global?

For most traders - especially those new to crypto or those handling sizable funds - the answer is a clear no. The exchange does not provide the essential building blocks of trust: a disclosed regulator, audited security, transparent fees, or an active user community.

That said, some highly risk‑tolerant users might experiment with a very small amount to test the platform’s withdrawal process, but even that carries the danger of funds being locked or lost without recourse. In practice, the opportunity cost of spending time on an unverified service outweighs any speculative upside.

Consider well‑established alternatives listed on reputable comparison sites such as NerdWallet, which routinely evaluate platforms on security, fees, and regulatory compliance. Until Burency Global publishes concrete proof of licence, audit reports, and verifiable volume, it remains best classified as a high‑risk exchange.

Frequently Asked Questions

Is Burency Global a regulated exchange?

The platform claims to be regulated, but no licensing authority or registration number is publicly disclosed. Neither FinCEN nor any known regulator lists Burency Global, so the claim cannot be verified.

Why does CoinMarketCap show Burency Global as untracked?

CoinMarketCap requires a minimum daily trading volume and transparent market‑pair data for tracking. Burency Global provides no public volume figures or order‑book information, so the service is classified as "untracked."

What security measures does the exchange actually use?

The website mentions generic security claims, but there is no disclosed cold‑storage ratio, audit report, or 2FA implementation detail. Independent verification from security firms or auditors is missing.

Are there any user reviews or community feedback?

A search across Trustpilot, Reddit, and the DFPI complaint database returns no credible user reviews. The lack of feedback is itself a warning sign.

Should I consider alternatives?

Yes. Established platforms such as Coinbase, Gemini, or Kraken provide clear regulatory status, audited security, transparent fees, and active user support, making them far safer choices.

Comments

Burency Global markets itself as a regulated platform, yet the regulatory veneer crumbles under scrutiny.

The platform's absence from FinCEN's MSB registry signals a fundamental compliance gap.

In the crypto ecosystem, licensing transparency functions as a trust anchor, and Burency provides none.

Their claimed cold‑storage strategy is not backed by an audit trail, which undermines custodial security.

Without third‑party certification, the supposed insurance coverage remains a marketing mirage.

Liquidity metrics are equally opaque; CoinMarketCap's untracked label means the order book depth is essentially invisible.

Traders attempting to execute sizable orders would likely encounter severe slippage.

Moreover, the fee schedule is conspicuously absent, leaving users to guess transaction costs.

Such ambiguity fuels an environment ripe for hidden spreads and surprise deductions.

User support appears to be a phantom service, with only a generic contact form on the website.

In the absence of documented response times, the risk of unresolved issues escalates dramatically.

From a risk‑management perspective, the composite red‑flag profile places Burency in the high‑risk tier.

Institutional investors would be hard‑pressed to justify exposure to a platform lacking verifiable safeguards.

For retail participants, the prudent route is to allocate capital to exchanges with audited security, disclosed licensing, and transparent volume data.

In short, Burency Global fails to meet the baseline criteria that define a trustworthy crypto exchange.

From a philosophical standpoint, the lack of verifiable licensing constitutes an epistemic void that erodes any claim to legitimacy.

The platform appears to operate in a gray ontological space where regulatory consent is presumed rather than demonstrated.

Such pretense is not merely sloppy; it is an aggressive affront to market participants seeking certainty.

Without concrete documentation, every transaction is built on sand.

This deficiency alone merits a skeptical stance.

Proceed with caution.

It is incumbent upon any financial intermediary to disclose its regulartory provenance, a standard that Burency Global egregiously disregards.

The moral imperative to protect investors is compromised by this opacity, rendering the platform ethically indefensible.

One must question whether such conduct aligns with the fiduciary duties expected in the crypto domain.

Regulatory silence, in this context, is tantamount to negligence.

Investors deserve transparency, not speculation.

Hence, the platform's practices are morally unacceptable.

While I see the allure of exploring new exchanges, the evidence presented raises significant concerns.

It would be prudent to prioritize platforms with verified security audits and clear licensing.

If you decide to test Burency with a minimal amount, monitor withdrawal times closely.

Still, the safest path remains established services that openly share compliance documentation.

Well, look, here's the thing, you have an exchange that braggs about “regulated”, yet provides no licence, no audit, no proof, and somehow expects users to trust it, right? :) It’s like buying a car without a VIN, a warranty, or even an engine, and still paying full price, lol. The liquidity claim is as solid as a vapor cloud, and the fee schedule is hidden better than a secret menu item, haha. If you enjoy mystery novels, go ahead, sign up, but don’t be shocked when your funds disappear, okay?? ;)

Sure, nothing to see here, just another “transparent” platform that hides everything.

It pretends to be secure but offers no audit or insurance proof, a classic red flag for anyone looking for safety.

I understand why some are curious about a fresh name in the market, yet the lack of verifiable details makes any enthusiasm risky.

If you choose to allocate a tiny test amount, keep a close eye on withdrawal speed and support responsiveness.

Even a small experiment can reveal whether the platform respects user funds.

Picture this: you’re stepping into a bustling marketplace, but the stalls are shrouded in fog, and the vendors whisper vague promises of safety.

The thrill of discovery can quickly turn into dread when you realize there’s no clear signage, no trusted guarantor, and no open ledger to prove the goods are real.

It’s a heart‑pounding scene, but the drama is best left on the stage, not in your wallet.

Choose a stage with bright lights and documented safety nets, and the story ends happily.

Ever wonder why a platform that markets itself to the Middle East would hide its regulatory paperwork like a secret treasure?

If transparency were a requirement, we’d see it on the homepage, but instead we get vague slogans and empty promises, right?

The mystery might be enticing, but the risk is far from a clever puzzle.

Here’s the practical rundown: first, check FinCEN’s MSB registry – Burency Global is not listed.

Second, verify the exchange’s cold‑storage ratio; without an audit report, you can’t trust the claim.

Third, examine CoinMarketCap; an “untracked” label means no reliable volume data.

Fourth, look for a transparent fee schedule; absence suggests hidden costs.

Following these steps will quickly reveal whether the platform is legit or just another glossy façade, which, honestly, it appears to be.

Hey folks, if you’re chasing reliable crypto venues, stick with the big names that publish audits and licensing 📊.

They keep your assets safer and give you clear fee charts, which makes trading smoother 😊.

Even if Burency sounds flashy, the peace of mind you get from established exchanges is worth the extra research 👍.

The saga of Burency Global reads like a cautionary tale, a narrative where hype overshadows hard evidence.

On one hand, the platform promises cutting‑edge services, but on the other, the missing licenses and invisible volume cast a long shadow.

Balancing optimism with prudence, I’d advise treating this as a curiosity rather than a mainstay.

Keep any exposure minimal, and monitor the ecosystem for any genuine compliance updates.

Honestly, I’d just avoid it unless they start showing real paperwork.

Quick tip: before you deposit, search the regulator’s database for the exchange’s license number, and check if any third‑party audit reports are publicly available. If you can’t find either, it’s safer to walk away 🙅♀️.

It’s absurd that an exchange would claim global reach while ignoring the basic regulatory standards that protect our financial sovereignty.

Your willingness to ignore the facts is astounding.