51% Attack Feasibility Calculator

Calculate Attack Feasibility

Attack Analysis

Enter your network parameters to see the attack analysis.

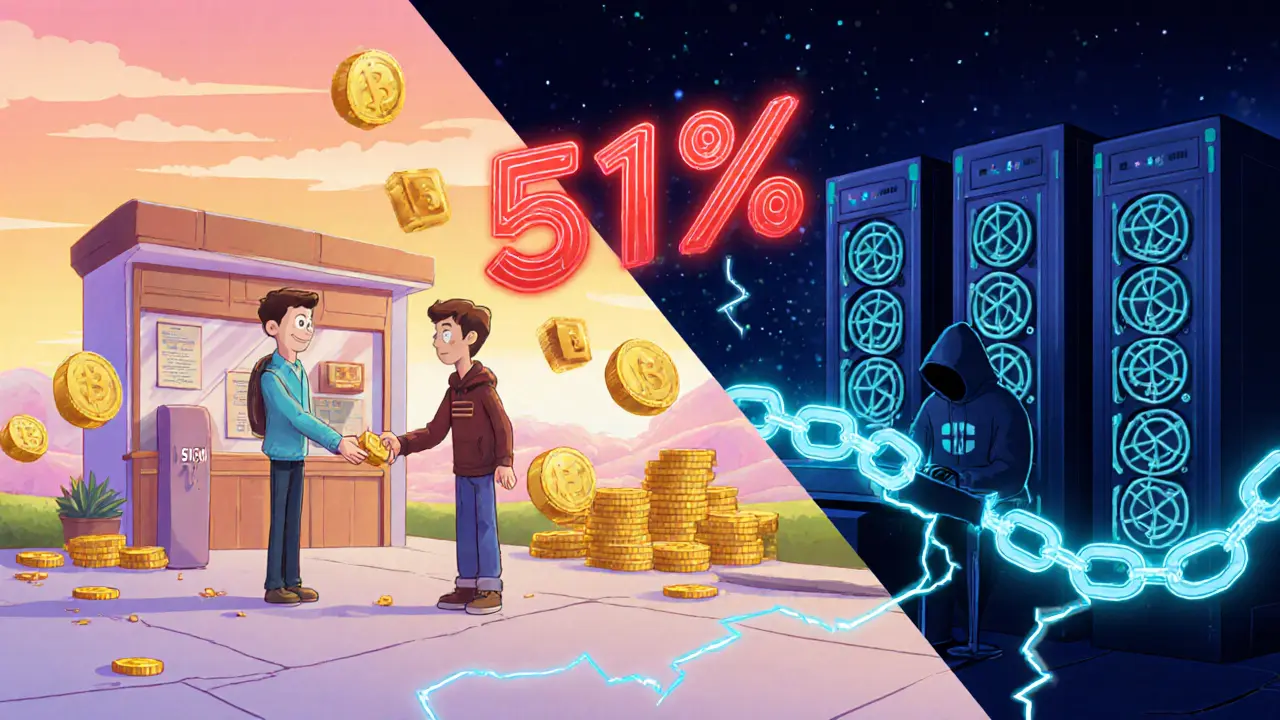

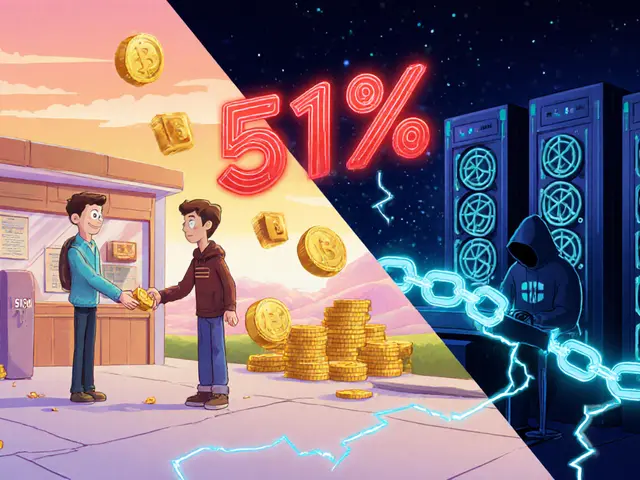

In the world of 51% attack is a majority attack where an individual or group controls over half of a blockchain’s mining power, a single actor can rewrite recent transaction history and spend the same coins twice. This phenomenon, also called a majority or double‑spend attack, exploits the way proof‑of‑work blockchains reach consensus. If you’ve ever wondered how a hacker could turn a legit purchase into a fraudulent one, the answer lies in the mechanics of double‑spending coupled with a 51% attack.

Key Takeaways

- A 51% attack lets an attacker build a longer chain that excludes a confirmed transaction, enabling double‑spending.

- Large networks like Bitcoin are practically immune because the cost of acquiring >50% hash rate far exceeds any profit.

- Smaller cryptocurrencies with low hash rates (e.g., Ethereum Classic) have suffered real‑world attacks.

- Protection focuses on decentralization, monitoring hash‑rate distribution, and exploring alternative consensus models.

- Detecting a potential attack involves watching mining pool dominance, sudden chain reorganizations, and abnormal block propagation.

What Is Double‑Spending?

When you send a cryptocurrency transaction, the network records it in a block. Double‑spending refers to the act of using the same digital tokens in two separate transactions. In a healthy blockchain, once a block is buried under enough successors, the transaction becomes irreversible. However, if an attacker can replace that block with an alternative chain, they can invalidate the original payment while keeping the coins for themselves.

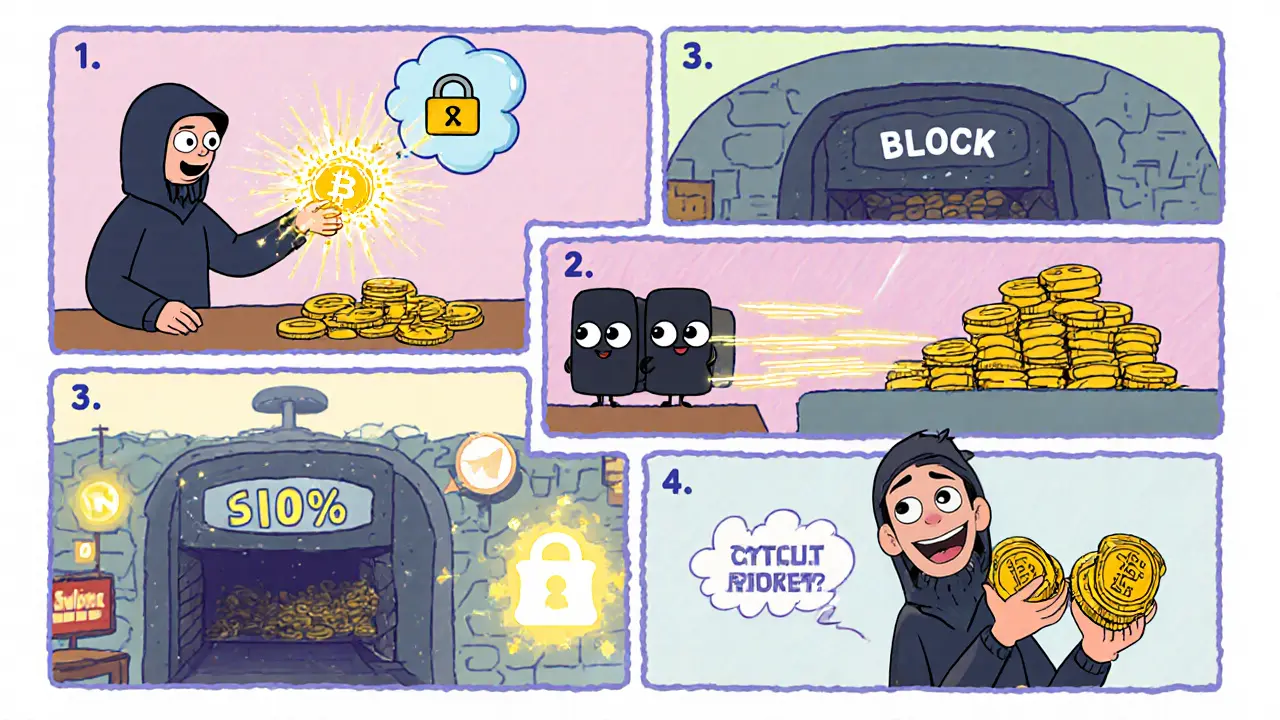

How a 51% Attack Enables Double‑Spending

The backbone of most cryptocurrencies is the proof‑of‑work consensus mechanism. Miners compete to solve a cryptographic puzzle; the first to solve creates the next block and receives a reward. Nodes always adopt the "longest" chain - the one with the most accumulated work.

- Spend normally. The attacker sends coins to a merchant, and the transaction is confirmed in blockX.

- Hide a private fork. Simultaneously, the attacker starts mining a secret chain from blockX‑1, excluding the merchant payment and instead sending the same coins to an address they control.

- Outpace the honest chain. Because the attacker controls >50% of the hash rate, their private chain grows faster than the public one.

- Trigger a reorganization. Once the secret chain becomes longer, honest nodes automatically switch to it, erasing the merchant’s transaction.

- Cash out. The attacker now holds the same coins twice - the merchant thinks they paid, while the attacker still has the funds.

Notice that the attacker cannot create coins out of thin air or modify other users’ balances; the damage is limited to their own transaction history.

Real‑World Cases: When Smaller Chains Got Crunched

Several lower‑hash‑rate networks have fallen victim to this technique:

- Ethereum Classic suffered a 51% attack in August2020, resulting in a 27‑block reorganization and the reversal of multiple transactions.

- Bitcoin Gold experienced a successful attack in May2021, where a single miner briefly controlled the majority of the network’s hash rate.

- Other niche coins such as Vertcoin and Monacoin have also reported temporary hash‑rate spikes that raised alarm bells among community watchers.

These incidents proved that while the theory was once dismissed as “impractical”, the economics of renting or repurposing mining hardware can make attacks profitable on modest networks.

Why Large Networks Remain Safe

The security of a blockchain is directly tied to its total hash power. Bitcoin’s network, for instance, processes exabytes of hashes per second, consuming megawatts of electricity. To acquire 51% of that power would require an investment running into billions of dollars - a cost that dwarfs any potential gain from a double‑spend.

Research from the MIT Digital Currency Initiative confirms that the “impossibility” assumption still holds for high‑hash‑rate systems. Even if an attacker bought enough ASICs, the hardware’s depreciation and the inevitable price drop of Bitcoin after a successful attack would render the effort unprofitable.

Detecting and Responding to a Potential Attack

Early warning hinges on monitoring the distribution of mining power. Key signals include:

- Mining pool dominance. If a single pool exceeds ~30‑35% of total hash rate, the risk of a coordinated takeover rises.

- Sudden hash‑rate spikes. Abrupt increases often precede an attempted 51% takeover.

- Chain reorganizations. More than a few blocks being replaced in a short window is a red flag.

Tools like Hashrate Distribution Charts and CoinDance provide real‑time visualizations of these metrics.

Mitigation Strategies for Developers and Communities

Project teams can harden their networks in several ways:

- Promote mining decentralization. Encourage a diverse set of pools and support solo miners.

- Introduce checkpointing. Periodically embed trusted block hashes into client software to prevent deep reorganizations.

- Switch consensus. Move to proof‑of‑stake or hybrid models that make hash‑rate attacks irrelevant.

- Implement rapid transaction finality. Use techniques like Lightning Network channels or sidechain settlements to reduce reliance on on‑chain confirmations.

Each measure raises the economic and technical hurdles an attacker must overcome.

Comparison: Attack Feasibility Across Different Networks

| Network | Average Hash Rate (TH/s) | Cost to Reach 51% (USD) | Historical Attack Record |

|---|---|---|---|

| Bitcoin | 200,000 | >$1.5billion | None |

| Ethereum Classic | 800 | $12million | 2020 |

| Bitcoin Gold | 150 | $2million | 2021 |

| Vertcoin | 30 | $350,000 | 2020 (attempt) |

The table illustrates why attacks cluster around smaller chains: the lower the total hash rate, the cheaper it is to dominate the network.

Future Outlook: Will 51% Attacks Resurface?

As mining hardware becomes more affordable and hash‑rate rental markets emerge, the barrier to acquiring majority power may shrink. However, the industry’s shift toward proof‑of‑stake (e.g., Ethereum’s “The Merge”) and the rise of decentralized validator sets suggest that the attack surface will evolve.

Continuous monitoring, transparent mining pool reporting, and community‑driven governance will remain essential. Projects that invest early in robust decentralization are likely to avoid the reputational damage that follows a successful attack - a damage often measured in double‑digit percentage price drops.

Frequently Asked Questions

Can a 51% attack create new coins?

No. The attacker can only reorganize existing blocks to reverse their own transactions. Minting new coins requires a protocol‑level bug, not mere hash‑rate control.

Why can’t an attacker steal funds from other users?

Transaction outputs are cryptographically locked to specific addresses. Even with a longer chain, the attacker cannot alter outputs that belong to other users without owning the private keys.

What’s the difference between a 51% attack and a regular double‑spend?

A regular double‑spend tries to broadcast two conflicting transactions, hoping one will be ignored. A 51% attack guarantees reversal by rebuilding the blockchain’s history, making the double‑spend certain.

How can users protect themselves from a potential attack?

Wait for more confirmations on low‑hash‑rate coins, use off‑chain payment channels, and prefer networks with transparent mining‑pool distribution.

Is proof‑of‑stake immune to 51% attacks?

Stake‑based systems replace hash power with economic stake. An attacker would need to acquire >50% of the total staked tokens, which is often financially prohibitive.

Comments

Great rundown on the mechanics! Double‑spending feels like a nightmare, but the way you broke down the attack steps makes it crystal clear.

For anyone running a small coin, the hash‑rate numbers you showed are a solid wake‑up call.

Remember, the community can toughen up by spreading mining across many pools.

Don’t let the fear freeze you – use the tools, keep an eye on pool dominance, and you’ll stay ahead.

Keep pounding that iron, and the network will stay safe.

The notion of majority control forces us to confront the very philosophy of trust in decentralized systems.

When a single entity can rewrite history, the social contract underpinning the blockchain erodes.

Yet, the economic calculus you presented suggests that true scarcity protects that trust.

It’s a delicate balance between technical design and human incentive.

Okay, I gotta say this whole thing reeks of a controlled narrative.

Why are we only looking at legit mining pools?

What about secret bot‑farms hidden in the dark web?

Everyone pretends the hash‑rate is transparent, but the real numbers are being fudged.

The "cost" you quote ignores the shadow market where you can rent ASICs for pennies.

And don’t even get me started on the alleged "impossibility" – governments could just subsidize an attack.

Wake up, people! The chain is more vulnerable than you think.

The explanation of the fork‑and‑reorg process is thorough and well‑structured.

It is important for newcomers to understand that a 51% attacker does not create new coins, only reverses their own transactions.

The example with merchant payments clarifies the real‑world impact.

Monitoring pool distribution, as you suggested, remains a primary defensive measure.

Wow, this is actually super helpful!

I love how you listed concrete mitigation steps – especially the checkpointing suggestion.

It’s like giving a first‑aid kit to a network.

Sorry for the typos, but the point stands: diversify mining, use hybrid consensus, and keep the community informed.

Even a dramatic lightning‑strike of hash‑rate can’t break a well‑prepared chain.

The historical cases you cited are quite illuminating.

The fact that Ethereum Classic fell victim in 2020 demonstrates that even established networks are not immune.

This underlines the necessity for rigorous monitoring and rapid response protocols.

Overall, an excellent synthesis of theory and practice.

Interesting analysis, but I can’t help but wonder whether the focus on hash‑rate overshadows other attack vectors.

For example, selfish mining can also destabilize consensus without a full 51% control.

Moreover, the rise of cloud‑based mining rentals might lower the barrier faster than projected.

Still, your tables give a clear picture of economic feasibility.

This post is a total waste of time.

Everyone knows the big players are already pulling the strings behind the scenes.

The so‑called "security" of Bitcoin is just a myth fed to the masses.

If you actually want safety, stop trusting any so‑called decentralized currency.

They’re all controlled by shadowy elites, and this article does nothing to expose that.

Thanks for the clear breakdown.

It’s good to see the numbers laid out plainly.

I’ll definitely keep an eye on confirmation counts for the smaller coins I use.

The risk calculations are utterly misguided.

Super helpful post! 😎

Seeing the cost per confirmation really puts things into perspective.

If you’re dealing with low‑hash‑rate coins, waiting for extra confirmations is a smart move.

Keep those analytics coming! 👍

One could argue that the very premise of a 51% attack reveals a deeper philosophical tension between trustless systems and human fallibility.

While the mathematics may be sound, the social contract implicit in decentralization is fragile.

Nevertheless, the empirical data you present grounds the discussion in reality.

It is a reminder that idealism must be tempered with pragmatic safeguards.

Allow me to expand upon the subtleties that underlie the seemingly straightforward narrative of majority attacks.

First, the classification of "high", "medium", and "low" security levels, while pedagogically convenient, obscures the continuous spectrum of risk that actually exists across disparate blockchain ecosystems.

Second, the economic model presented assumes a static cost per terahash, neglecting the dynamic pricing mechanisms that arise in the spot markets for mining hardware and electricity-variables that can swing dramatically within weeks, if not days.

Third, one must consider the geopolitical aspects: certain jurisdictions subsidize mining operations, effectively lowering the barrier to a 51% takeover for actors aligned with those governments.

Fourth, the social dimension cannot be ignored; mining pools are often governed by informal agreements, and a sudden shift in pool loyalty can precipitate a rapid concentration of hash power, as history has shown in the case of Bitcoin Gold.

Fifth, the cryptographic assumptions themselves merit scrutiny: while proof‑of‑work is resilient to classic pre‑image attacks, the advent of quantum computing, albeit distant, could alter the cost structure in unpredictable ways.

Sixth, defensive mechanisms such as checkpointing, while useful, introduce a form of centralization that contradicts the original ethos of blockchain, raising a paradoxical trade‑off between security and decentralization.

Seventh, the notion of "finality" in proof‑of‑work chains is probabilistic; the more confirmations one awaits, the lower the probability of a successful reorg, yet the exact threshold remains a matter of risk tolerance rather than an absolute guarantee.

Eighth, many newer chains are experimenting with hybrid consensus models-combining PoW with PoS-to mitigate the pure hash‑rate attack vector, but such hybrids introduce their own attack surfaces, such as stake‑grinding.

Ninth, the community response to an active 51% attack often includes third‑party interventions, such as coordinated hash‑rate donations to the honest side, a phenomenon observed during the Monacoin incident.

Tenth, the profitability analysis presented in the calculator should also factor in potential market reactions; a successful attack could precipitate a sharp price decline, thereby eroding the attacker’s potential gains.

Eleventh, developers must remain vigilant about network upgrades that could inadvertently lower the difficulty of mounting a 51% attack, for instance by changing the difficulty retargeting algorithm.

Twelfth, the transparency of mining pool statistics, while beneficial, can be gamed through the use of stealth mining operations that conceal true hash‑rate contributions.

Thirteenth, educators and newcomers to the space should be equipped with not only technical tools but also a nuanced understanding of the socio‑economic incentives that drive attacker behavior.

Fourteenth, academic research continues to explore contrarian consensus models, such as Proof‑of‑Authority, which shift the trust model away from raw computational power entirely.

Finally, the overarching lesson is that security is not a static feature but an evolving process that must adapt to technological, economic, and regulatory changes.

Therefore, a holistic approach-combining vigilant monitoring, diversified consensus, and community preparedness-remains the most robust defense against the ever‑present specter of majority attacks.

While the data is useful, it glosses over the fact that many of these chains lack proper governance.

Without a clear protocol for emergency responses, the community is left scrambling when an attack materializes.

Thus, technical metrics alone cannot guarantee safety.

Great job laying out the mitigation strategies.

Encouraging solo miners and smaller pools can truly decentralize hash‑rate.

Also, the suggestion to adopt checkpointing should be balanced against the risk of centralizing trust.

Overall, a very pragmatic guide for developers looking to harden their networks.

The numbers you’ve compiled are precise, and the conclusions are spot‑on.

It’s clear that Bitcoin’s massive hash‑rate makes a 51% takeover financially untenable.

However, smaller networks must consider the volatility of hardware pricing when planning defenses.

Implementing rapid finality solutions could further reduce exposure.

Keep the community updated with these metrics.

Excellent analysis the data is solid.

When we reflect on the nature of trust, it becomes evident that any system reliant on majority power carries an inherent philosophical paradox.

Security, in this context, is a social construct as much as a technical one.

This is a superb synthesis of theory and actionable insight!

The dramatics of a 51% attack are now matched with real‑world cost calculations, which is exactly what developers need.

By pushing for diversified mining and checkpointing, you give the community a clear roadmap.

Keep delivering this level of depth – it empowers projects to defend themselves effectively.

Honestly, most folks don’t even bother checking confirmations, and they’re fine.

Looks like another scare‑tactic article to me.