MetaTdex Fee Calculator

Calculate Your MetaTdex Trade Fees

MetaTdex has an estimated fee structure between 0.20% and 0.30% per trade. Enter your trade amount to see approximate fees.

Estimated Fees

How Your Fees Compare

MetaTdex fees are estimated at 0.20%–0.30% based on industry benchmarks. Here's how they compare to other major DEXs:

| MetaTdex | Uniswap | PancakeSwap | OKX DEX | |

|---|---|---|---|---|

| Fees | 0.20% - 0.30% | 0.30% | 0.25% | Tiered: 0% - 0.85% |

| Best For | Simple BSC/HECO swaps | High liquidity, Ethereum ecosystem | Low gas fees on BSC | Advanced features, institutional liquidity |

Note: Actual fees may vary based on liquidity depth and token pair availability. MetaTdex has not published exact fee structures.

If you’ve been scanning the crypto market for a DEX that can handle both Binance Smart Chain and Huobi Eco Chain trades, you’ve probably stumbled across MetaTdex review headlines. The platform boasts a $4.7billion cumulative volume and a user base of over 300,000, yet it’s missing from most top‑10 DEX lists. This article breaks down what MetaTdex actually offers, where it shines, where it falls short, and whether it deserves a spot in your trading toolkit.

What Is MetaTdex?

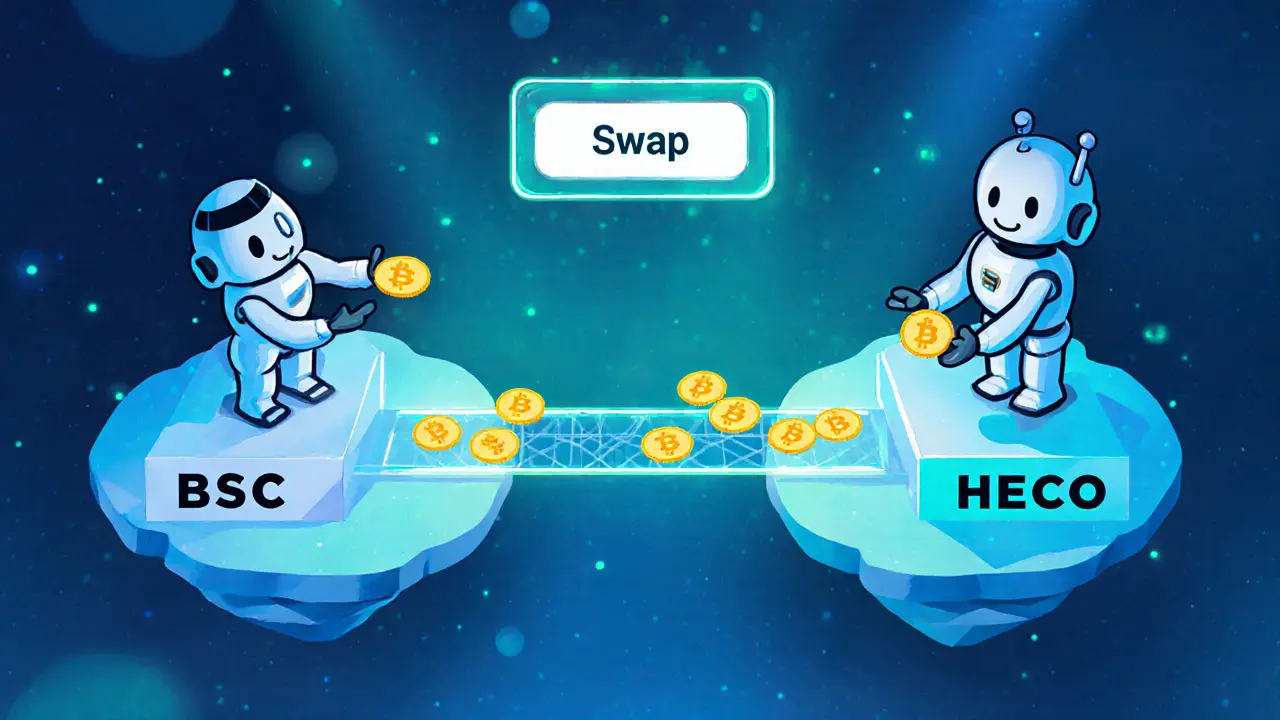

MetaTdex is a multi‑chain decentralized exchange (DEX) that supports Binance Smart Chain (BSC) and Huobi Eco Chain (HECO). According to its CoinMarketCap profile (dated 14Oct2025), the platform has processed over USD4.7billion in trades and serves more than 300000 registered users across 20+ countries.

How the Multi‑Chain Model Works

MetaTdex does not run its own blockchain; instead, it builds smart‑contract front‑ends on top of existing networks. On BSC, trades settle within roughly three seconds thanks to the Proof‑of‑Staked‑Authority (PoSA) consensus. On HECO, the Delegated Proof‑of‑Stake (DPoS) model delivers similar block times while keeping gas fees low. By deploying identical contract logic on both chains, MetaTdex lets users swap assets without hopping between wallets or bridging tokens manually.

Security Posture - What We Know (and What We Don't)

Security is the biggest red flag for any DEX. For MetaTdex, public data is sparse:

- No audited smart‑contract reports are listed on the official site.

- There is no publicly disclosed bug‑bounty program.

- No history of hacks or exploits has been reported on major forums such as Bitcointalk or Reddit.

In contrast, platforms like OKX DEX publish regular audit certificates and operate private mempools to mitigate MEV attacks. The absence of comparable documentation for MetaTdex makes it harder to gauge its resilience against front‑running or contract vulnerabilities.

Fees and Liquidity - Numbers Matter

MetaTdex does not appear in Finder’s fee‑comparison charts, so exact taker and maker rates are unclear. Most mid‑tier DEXs charge between 0.20% and 0.30% per trade, while premium platforms like OKX DEX offer tiered fees (0% for top tokens, 0.25% for mid‑cap, 0.85% for low‑liquidity assets). Without published fee schedules, traders must either guess or rely on on‑chain analytics, which adds friction.

Liquidity depth is equally opaque. The platform’s $4.7billion total volume translates to roughly $350million in daily activity-far below the multi‑hundred‑million daily volumes of Uniswap and PancakeSwap. Lower liquidity can mean higher slippage, especially for low‑volume tokens.

User Experience - What to Expect

Because MetaTdex’s UI is not widely reviewed, we rely on the limited screenshots and community posts that do exist. The interface follows a standard DEX layout: a token selector, amount fields, and a “Swap” button. However, users have reported:

- Limited language support (primarily English).

- No native mobile app; the platform is accessed via responsive web design.

- Sparse documentation on onboarding, wallet integration, and troubleshooting.

Customer support seems to be limited to a Telegram channel, with no guaranteed response time.

Pros and Cons - A Quick Verdict

- Pros

- Supports two major EVM‑compatible chains, enabling cross‑chain swaps without external bridges.

- Significant cumulative volume suggests a baseline level of activity.

- Not listed on major scam registries, indicating no known fraud allegations.

- Cons

- Lack of published security audits or bug‑bounty incentives.

- Unclear fee structure and potentially higher slippage due to modest liquidity.

- Minimal presence in reputable DEX rankings, implying limited industry trust.

- No dedicated mobile app or extensive educational resources.

How MetaTdex Stacks Up - Comparison Table

| Feature | MetaTdex | Uniswap (v4) | PancakeSwap | OKX DEX |

|---|---|---|---|---|

| Supported Chains | BSC, HECO | Ethereum, Optimism, Base | BSC, Polygon, Arbitrum | Ethereum, BSC, HECO, Solana |

| Daily Volume (Oct2025) | ≈$350M | ≈$1.5B | ≈$800M | ≈$600M |

| Fee Structure | Undisclosed (est. 0.20‑0.30%) | 0.30% taker | 0.25% taker | Tiered 0‑0.85% |

| Security Audits | None publicly listed | Multiple third‑party audits | Audited (Certik, PeckShield) | Regular audits + MEV protection |

| Liquidity Depth | Medium (limited pair variety) | High (thousands of pairs) | High (wide token list) | High (institutional market makers) |

| Mobile Access | Responsive web only | Web + native apps | Web + native apps | Web + native apps |

Is MetaTdex Worth Your Trade?

Answering the core question depends on your priorities:

- If you need a simple BSC/HECO swap without leaving your wallet, MetaTdex can be a handy bridge. The lack of a mobile app isn’t a deal‑breaker for desktop‑oriented traders.

- If you value audited security, the platform’s silence on audits should push you toward alternatives like Uniswap or OKX DEX.

- If fees are a top concern, the unknown fee schedule adds risk. You might end up paying more than the advertised 0.20% on other DEXs.

- If you trade low‑liquidity tokens, the modest depth may cause slippage that erodes your profit margins.

For most users, MetaTdex works as a niche cross‑chain tool rather than a primary exchange. Pair it with a more established DEX for larger trades or for assets not listed on MetaTdex.

Future Outlook - What’s Next for MetaTdex?

There are no concrete roadmap announcements as of October2025. The platform remains operational, but its lack of presence in discussion about gas‑free trading, tiered fees, or advanced analytics suggests a slower development pace. Traders should keep an eye on official channels for any upcoming security audits or feature releases before allocating significant capital.

Frequently Asked Questions

What chains does MetaTdex support?

MetaTdex currently runs on Binance Smart Chain (BSC) and Huobi Eco Chain (HECO), both of which are EVM‑compatible networks.

Is MetaTdex safe to use?

Safety is uncertain because the platform has not published any independent security audits. While there are no known hacks, the lack of transparency means you should only trade amounts you’re comfortable risking.

How do fees on MetaTdex compare to other DEXs?

Exact fees are not disclosed publicly, but industry estimates put them between 0.20% and 0.30% per swap, which is higher than the 0%‑0.25% tiers seen on OKX DEX and similar to standard rates on Uniswap.

Can I trade directly from my hardware wallet?

Yes. MetaTdex connects to any Web3‑compatible wallet like MetaMask, Trust Wallet, or hardware wallets that can interact with BSC and HECO via those extensions.

What’s the best way to get support?

The primary support channel is the official Telegram community. There is no email ticket system or live‑chat, so response times can vary.

Comments

In the realm of decentralized exchanges, transparency of fee structures is not merely a convenience but a moral imperetive; users deserve to know precisely what they are paying, and any obfuscation is, frankly, unethical. MetaTdex claiming a range of 0.20%‑0.30% without a detailed breakdown feels like a breach of that principle. It would be prudent for the team to publish a clear schedule so traders can make informed decisions.

Looking at the numbers, MetaTdex sits comfortably between Uniswap and PancakeSwap. For folks who value lower gas on BSC, the 0.20%‑0.30% fee is quite reasonable, especially when you consider the added simplicity of swapping HECO tokens.

Yo, the fee calculator is slick, but let me break it down-your slippage, liquidity depth, token pair volatility all factor into the real cost, so that 0.20%‑0.30% is just a baseline, not the full story, bro.

Oh great, another "multi‑chain" DEX that pretends to be revolutionary 🙄. Sure, the fees look decent, but have you actually tested the bridge stability?

MetaTdex feels like the middle child of DEXs.

Fees? meh-just another number to stare at while the market does its thing.

I appreciate the effort to give users a fee calculator. It helps newcomers get a quick sense of cost without diving into contract code.

Nice work on the UI! The calculator is simple enough for anyone to use, and the comparison table gives a clear snapshot of where MetaTdex stands.

While the fee range is competitive, remember that actual costs can swing based on liquidity depth. If you’re swapping low‑volume tokens, you might see a higher effective fee due to price impact. Also, the tiered model on OKX DEX shows that there’s room for improvement if MetaTdex wants to attract higher‑volume traders.

From a cultural standpoint, MetaTdex’s focus on BSC/HECO bridges could be a double‑edged sword. It simplifies swaps for those ecosystems, yet limits exposure to the deeper liquidity pools on Ethereum. If you’re looking for the cheapest route, always compare the total cost-including bridge fees-against a single‑chain DEX.

Happy to see a fee calculator! 🎉 Keeps things transparent and makes it easier to plan trades. Keep it up!

Honestly, anyone who thinks a 0.20%‑0.30% fee is “low” is ignoring the hidden costs of cross‑chain bridges. Look beyond the headline numbers.

Well, if you enjoy mediocrity you’ll love MetaTdex’s middle‑of‑the‑road fees.

One could argue that the modest fee spread reflects a balanced approach, yet it also hints at a lack of ambition.

The fee calculator is a useful tool, but it doesn’t capture the full picture. Users should also consider network congestion and potential bridge fees when estimating total costs.

Let’s break this down step by step, because the surface‑level numbers can be misleading. First, the advertised 0.20%‑0.30% fee is a static range that does not account for dynamic market conditions. When liquidity is shallow, the price impact can easily add an extra 0.1%‑0.2% to the effective cost, especially on less popular token pairs. Second, MetaTdex operates across BSC and HECO, which means every trade potentially incurs a bridge transaction. Bridge fees vary widely; some can be a flat $0.10, others a percentage of the trade, and they are not reflected in the calculator at all. Third, gas fees on BSC are currently low, but they can spike during network congestion, raising the overall cost beyond the nominal fee. Fourth, the comparison table shows OKX DEX offering a tiered fee that can go down to 0%, which could be a better option for high‑volume traders who qualify for lower tiers. Fifth, the user experience matters: a slick UI may hide complexities, but seasoned traders will still run simulations to validate the true cost. Sixth, the lack of a published exact fee structure suggests the team may adjust rates without notice, adding another layer of uncertainty. Seventh, for anyone swapping stablecoins like USDT, the fee difference is marginal, but for volatile assets the fee variance becomes more significant. Eighth, the calculator assumes a perfect trade execution; slippage is not incorporated, and on volatile pairs that can be a few basis points. Ninth, one should also consider the opportunity cost of capital tied up during longer bridge times. Tenth, security audits of the bridging contracts play a role in risk assessment, which indirectly affects cost considerations. Eleventh, institutional liquidity on platforms like OKX can provide tighter spreads, which may offset higher nominal fees. Twelfth, the platform’s roadmap and upcoming features could alter fee structures, so staying informed is crucial. Thirteenth, community feedback often reveals hidden costs not captured by official documentation. Fourteenth, always compare the total cost-including fee, gas, bridge, and slippage-before executing a sizable trade. Finally, the best practice is to run a small test transaction, review the actual fees incurred, and then scale up with confidence. In short, MetaTdex offers competitive nominal fees, but the real cost is context‑dependent.

Wow, that was a wall of text-thanks for the deep dive.

Great job on the fee calculator, it makes planning trades a breeze. Just remember to keep an eye on bridge fees.

Indeed, the calculator is helpful, but a reminder about hidden costs is always welcome.

Did anyone notice that the fee range aligns suspiciously with the platform’s token launch schedule? Could be a hidden incentive mechanism.

The comparison table is useful, but I would also like to see a side‑by‑side chart of average transaction times across these DEXs.

Adding to that, transaction latency can be a deal‑breaker for arbitrageurs. MetaTdex should publish average confirmation times.

The fee calculator is a step in the right direction, but transparency must extend to bridge costs and slippage estimates for the truly informed trader.

Agreed-full cost visibility is essential for serious investors.

Overall, MetaTdex looks promising, but keep testing with small amounts before committing large capital.