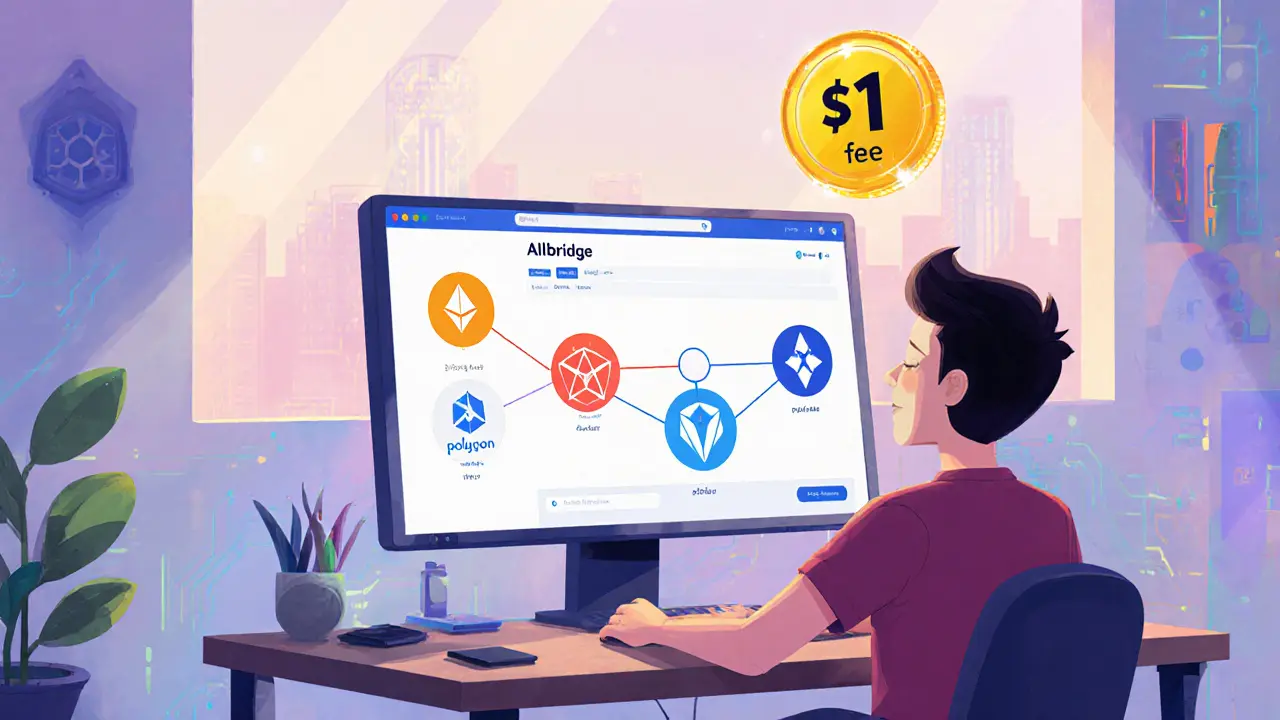

Allbridge (ABR) is a cross‑chain bridge that lets you move tokens between Ethereum, Solana, Polygon and more for a flat $1 fee. Learn how it works, fees, staking, security and how it stacks up against Wormhole and Multichain.

Crypto Bridge Fees: What You Need to Know

When navigating the world of digital assets, crypto bridge fees, the charges you pay to transfer tokens across different blockchains. Also known as bridge costs, it directly impacts how much you actually receive on the other side of a move. Understanding these fees helps you avoid surprise deductions and plan more efficient trades.

Understanding the Cost Landscape

At the heart of any fee structure lies the cross‑chain bridge, a protocol that locks assets on one chain and mints equivalents on another. These bridges rely on network fees, the gas or transaction costs paid to validators on each participating chain. The relationship is clear: crypto bridge fees encompass both the bridge service charge and the underlying network fees. The more congested a network, the higher its gas price, and the larger the total cost you’ll see. Some bridges bundle the costs, while others list them separately, so it’s crucial to read the fee breakdown before confirming a transfer.

Security plays a silent but powerful role in the fee equation. A secure bridge, one that audits its contracts, uses multi‑sig guardians and monitors for exploits, usually commands a higher premium because developers need to cover audit expenses and ongoing monitoring. Conversely, less‑secure bridges may advertise low fees, but the hidden risk can turn a cheap transfer into a costly loss if an attack occurs. In practice, bridge security influences fee structures: higher‑security solutions often charge a modest safety margin, while risky options may appear cheap only on paper.

Another often‑overlooked factor is slippage, the difference between expected and actual amount received due to price movement during the bridging process. Slippage doesn’t appear as a line‑item fee, but it effectively reduces the net value you receive. Bridges that offer built‑in price oracles can mitigate slippage, yet they might add a small fee for that service. Recognizing how slippage interacts with explicit fees lets you calculate a more realistic total cost and decide whether a particular bridge meets your tolerance for both price impact and expense.

Armed with these insights, you can compare bridges not just on headline numbers but on the full picture: network congestion, security posture, and hidden slippage. Below you’ll find a curated list of articles that dive deeper into each of these elements, show real‑world fee calculations, and offer tips on how to keep your bridging costs as low as possible while staying safe.