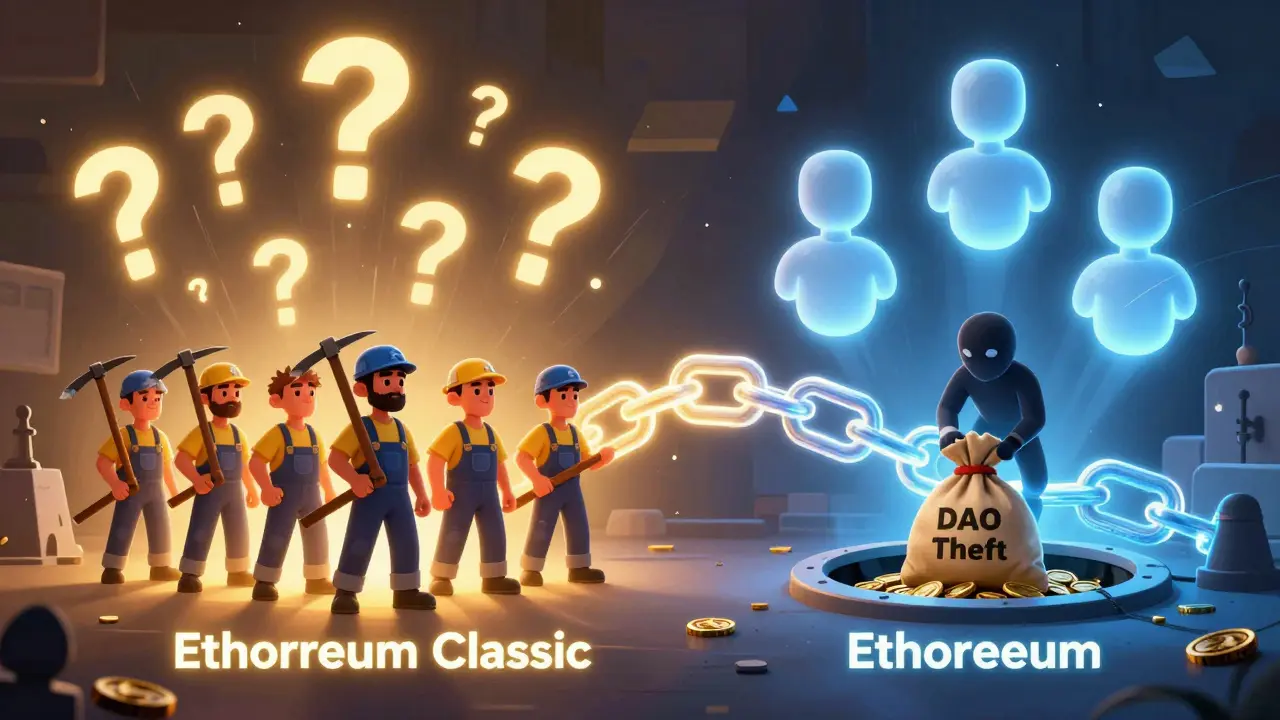

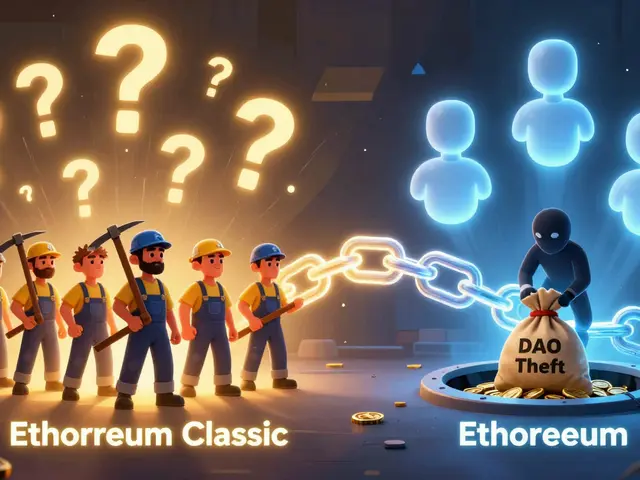

On July 30, 2015, the Ethereum blockchain went live. It wasn’t just another cryptocurrency - it was a platform for smart contracts, decentralized apps, and code that couldn’t be stopped. Then, in 2016, everything changed. A hacker drained $60 million worth of Ether from a project called the DAO. The community panicked. Some said: reverse it. Others said: never.

The split wasn’t just technical. It was ideological. Half the network chose to rewrite history. The other half refused. That’s how Ethereum Classic (ETC) was born - not as a copy, but as a commitment. To the original code. To the original rules. To the idea that once something is written on the blockchain, it stays written.

How Ethereum Classic Got Its Start

The DAO was supposed to be a decentralized venture fund. Anyone could invest, vote on projects, and earn returns. But a flaw in its code let someone drain 3.6 million Ether - about 14% of Ethereum’s total supply at the time. The Ethereum Foundation proposed a hard fork: a clean reset that erased the theft. It worked. The stolen funds were returned. The new chain became what we now call Ethereum (ETH).

But a group of developers, miners, and users said no. They believed changing the blockchain to fix a mistake was worse than the mistake itself. If a system can be altered by a vote, it’s not decentralized. It’s just another corporation with a ledger. So they kept mining the original chain - the one with the theft still in it. That chain became Ethereum Classic.

It wasn’t a protest. It was a principle. Ethereum Classic is a blockchain that refuses to reverse transactions, even under pressure. Also known as ETC, it operates with the same code as Ethereum did before the fork, and uses the same Ethereum Virtual Machine (EVM) to run smart contracts.

How ETC Works - Same Tech, Different Philosophy

Ethereum Classic runs on the same core tech as Ethereum did in 2015: accounts and balances, state transitions, and the Ethereum Virtual Machine. That means if you built a dApp on Ethereum before 2016, you could move it to ETC with almost no changes.

But here’s where they diverge:

- Consensus: ETC still uses proof-of-work (PoW). Miners solve puzzles with powerful hardware to secure the network. Ethereum switched to proof-of-stake (PoS) in 2022 - no mining, just staking.

- Supply: ETC has a hard cap: 210.7 million coins. Once that’s mined, no more will be created. Ethereum has no cap - new coins are still issued annually.

- Philosophy: ETC believes in immutability. No exceptions. Ethereum believes in flexibility. If something goes wrong, fix it.

The difference isn’t just technical - it’s cultural. ETC’s community sees itself as the true heir to Satoshi’s vision: code as law. Ethereum’s community sees itself as evolving - adapting, improving, responding.

Why ETC Still Matters in 2026

After Ethereum left mining behind, ETC didn’t fade. It grew stronger.

In 2025, the network’s hashrate hit 300 terahashes per second (TH/s). That’s more than any other proof-of-work blockchain running smart contracts. Why? Because miners who left Ethereum after its switch found a new home. And they brought their rigs with them.

The Thanos Upgrade in 2024 made mining ETC more profitable. It adjusted block rewards and reduced difficulty spikes. Suddenly, mining wasn’t just a political act - it was a smart financial move. Miners from Bitcoin, Litecoin, and even Ethereum Classic’s own past flooded in. The network became more secure than ever.

Today, ETC is the largest smart contract blockchain secured by proof-of-work. That’s not a fluke. It’s a statement. For people who distrust proof-of-stake - who worry validators could be censored, bribed, or regulated - ETC offers a working alternative.

What You Can Do With ETC

ETC isn’t just a store of value. It’s a working platform.

- Pay for gas: Every smart contract execution, every token transfer, every dApp interaction costs ETC as gas. It’s the fuel.

- Build dApps: Developers can deploy decentralized apps on ETC using the same tools they use for Ethereum. Solidity, Remix, MetaMask - all work.

- Run DAOs: There are active DAOs on ETC, from community treasuries to funding open-source projects. No central authority. No freeze button.

- Trade or hold: ETC is listed on Binance, Kraken, KuCoin, and over 150 other exchanges. It’s liquid. It’s tradable. And with only 142 million coins in circulation out of a 210.7 million cap, it’s still far from max supply.

The price of ETC was $8.64 USD on February 16, 2026. That’s down from its all-time high of $140 in 2021. But price isn’t the whole story. The network’s security, mining activity, and developer activity tell a different one.

ETC vs ETH: The Real Divide

People often compare Ethereum Classic to Ethereum. But they’re not rivals. They’re opposites.

| Feature | Ethereum Classic (ETC) | Ethereum (ETH) |

|---|---|---|

| Consensus Mechanism | Proof-of-Work (PoW) | Proof-of-Stake (PoS) |

| Total Supply Cap | 210,700,000 ETC | No cap |

| Transaction Reversal | Never allowed | Allowed (e.g., DAO fork) |

| Network Security (2026) | 300 TH/s hashrate | Secure via staked ETH, not mining |

| Primary Use Case | Immutable smart contracts | DeFi, NFTs, enterprise dApps |

| Development Focus | Stability, security, decentralization | Scalability, speed, user adoption |

ETC doesn’t try to compete with Ethereum’s scale. It doesn’t need to. It offers something else: predictability. If you want a blockchain that won’t change its rules because a group of people voted to, ETC is the only one left.

Who Uses Ethereum Classic Today?

It’s not for everyone.

If you’re a DeFi trader using Uniswap or a NFT collector buying Bored Apes - you’re probably on Ethereum. ETC doesn’t have the same apps. It doesn’t have the same liquidity.

But if you’re someone who:

- Believes no blockchain should ever be reversed

- Worries that proof-of-stake centralizes power in the hands of big stakers

- Wants to mine a smart contract chain with real demand

- Values long-term security over short-term speed

Then ETC isn’t just another coin. It’s a statement.

The Ethereum Classic Cooperative, a community-led group, funds development, organizes meetups, and supports wallet integrations. There’s no VC funding. No corporate backing. Just developers, miners, and users who believe in the original idea.

The Future of ETC

Will ETC ever hit $100 again? Maybe. Maybe not.

But its future isn’t about price. It’s about persistence.

As governments crack down on crypto, as regulators demand the ability to freeze wallets, as exchanges comply with KYC rules - the idea of an unstoppable blockchain becomes more valuable. ETC is the only major smart contract chain that has never given in.

Its mining network is growing. Its community is quiet but steady. Its code is battle-tested. And in a world where everything changes - ETC stays the same.

That’s not a weakness. It’s the whole point.

Is Ethereum Classic the same as Ethereum?

No. Ethereum Classic (ETC) and Ethereum (ETH) split in 2016 after the DAO hack. ETC kept the original blockchain with the theft still recorded. ETH reversed the transaction. Since then, they’ve evolved separately - with different rules, communities, and development goals.

Can I mine Ethereum Classic?

Yes. ETC still uses proof-of-work mining with the Ethash algorithm. It’s one of the few major smart contract blockchains that still allows mining. With a hashrate of over 300 TH/s in 2026, it’s one of the most secure PoW networks for smart contracts.

Does Ethereum Classic have a supply cap?

Yes. ETC has a hard cap of 210,700,000 coins. About 142 million are already in circulation. This makes it deflationary by design - unlike Ethereum, which has no supply cap and continues issuing new coins annually.

Is Ethereum Classic a good investment?

ETC isn’t a mainstream asset like Bitcoin or Ethereum. It’s a niche play for those who value immutability, decentralization, and proof-of-work security. Its value comes from its philosophy as much as its technology. If you believe in an unchangeable blockchain, ETC has proven it can survive - even thrive - without chasing trends.

Can I use MetaMask with Ethereum Classic?

Yes. MetaMask supports ETC. Just add the Ethereum Classic network manually using the Chain ID 61, RPC URL https://ethereumclassic.network, and symbol ETC. Once set up, you can send, receive, and interact with ETC-based dApps just like you would on Ethereum.

Comments

Lmao ETC is just Bitcoin with smart contracts and a god complex. 🤡