Crypto Tax Calculator for Mexico

Calculate Your Crypto Tax Liability

Determine how much tax you might owe based on Mexican regulations, including the MXN $90,000 capital gains exemption and progressive income tax rates.

Add transactions to calculate your capital gains.

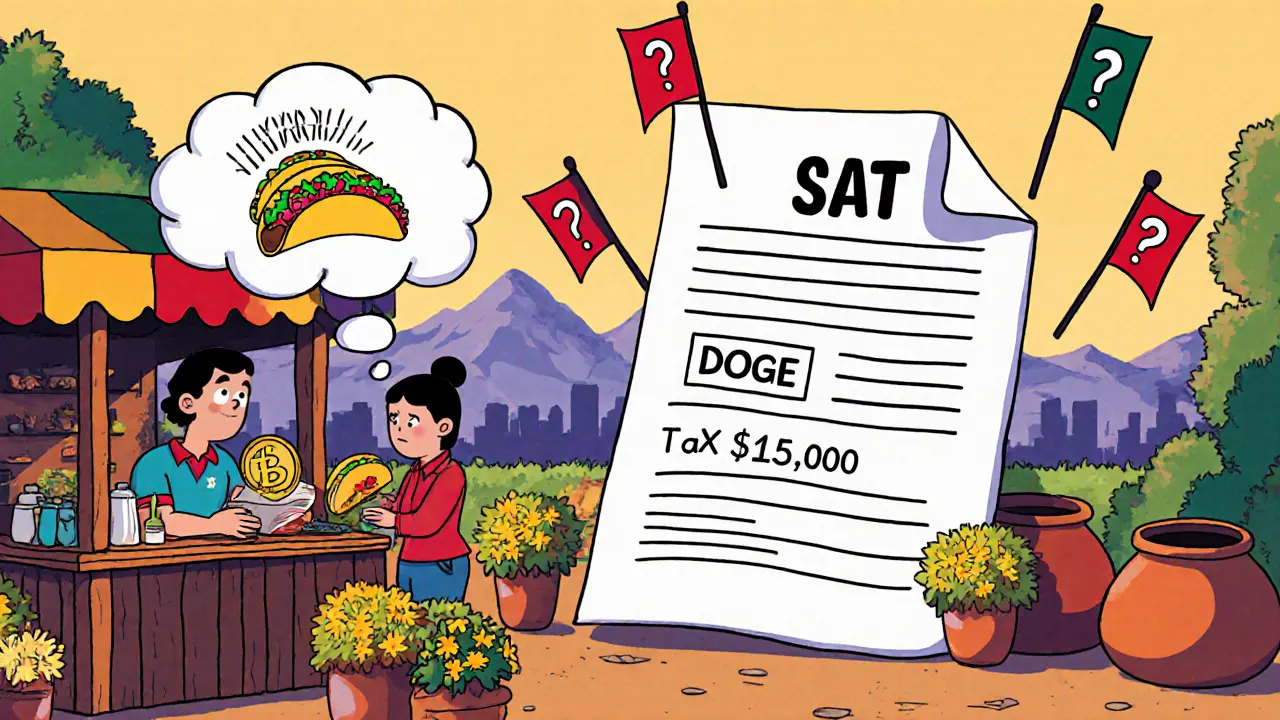

When you buy, sell, or spend cryptocurrency in Mexico, you might think it’s just a digital transaction. But the Mexican tax authorities see it differently. Every time you trade Bitcoin for Ethereum, use Litecoin to pay for groceries, or cash out your crypto for pesos, you’ve triggered a taxable event. Unlike countries with clear crypto tax rules, Mexico doesn’t have a dedicated law for digital assets. Instead, it treats crypto like any other movable property - and that creates a lot of confusion for everyday users.

How Crypto Is Classified in Mexico

Under Mexico’s Federal Civil Code, cryptocurrency is classified as an intangible movable asset. That means it’s not money. It’s not legal tender. It’s not a debt instrument. It’s an asset you own - like a piece of art, a car, or gold. This classification is critical because it determines how taxes are applied. If you hold Bitcoin and its value goes up, you don’t owe tax until you sell it, trade it, or spend it. Holding alone doesn’t trigger a tax bill. This is different from places like the U.S., where the IRS treats crypto as property and requires you to track every single trade. Mexico follows the same principle but without official guidance on how to calculate cost basis or which accounting method to use. Most tax professionals default to First-In-First-Out (FIFO), meaning the first crypto you bought is the first one you’re considered to have sold.Taxing Crypto Income: What Counts as Income?

If you earn crypto, it’s treated as income. That includes:- Receiving crypto as payment for goods or services

- Mining new coins

- Staking rewards

- Airdrops you claim

- Yield farming returns from DeFi platforms

Crypto Capital Gains: When You Profit

Capital gains come into play when you sell or exchange crypto for something else. That includes:- Selling Bitcoin for Mexican pesos

- Trading Ethereum for Solana

- Using Dogecoin to pay for a flight

Individual Tax Rates: Progressive, Not Flat

Mexican individuals pay income tax on crypto gains using a progressive scale that ranges from 1.92% to 35%. Your rate depends on your total annual income - not just crypto profits. So if you earn MXN $500,000 a year from your job and make MXN $100,000 from crypto, your total income of MXN $600,000 pushes you into a higher bracket. But there’s a break: Mexican individuals get an annual exemption of up to MXN $90,000 (about $4,000 USD) on capital gains from movable property. That means if your total crypto gains for the year are below that amount, you don’t owe any tax. For many casual users - someone who buys a little Bitcoin and sells it for a small profit - this exemption covers everything. But if you’re an active trader, doing multiple crypto-to-crypto swaps every week, you’ll likely blow past that limit. Each trade adds to your total gains. And since exchanges don’t report to the tax authority, it’s up to you to track every single one.

Corporate Crypto Tax: Flat 30%

Businesses in Mexico pay a flat 30% corporate income tax on all crypto gains, no matter how long they held the asset. There’s no exemption. No lower rate for long-term holdings. If your company buys Ethereum and sells it for a profit, 30% of that profit goes to the government. This applies to any legal entity - startups, LLCs, corporations. Even if you’re a freelancer who accepts crypto as payment, you’re considered a business for tax purposes. That means you need to file monthly and annual tax returns, keep detailed records, and report all crypto transactions.What You Must Record

The Mexican tax authority (SAT) doesn’t give crypto-specific recordkeeping rules, but they expect you to follow general property tax rules. That means you need to document:- Date and time of each acquisition

- Amount of crypto received

- Cost in Mexican pesos (based on exchange rate at the time)

- Source of funds (bank transfer, other crypto, etc.)

- Date and time of each disposal

- Value in pesos at time of sale or exchange

- Counterparty (if known - like an exchange or person you traded with)

Reporting Requirements: AML Triggers

Beyond income tax, Mexico has strict anti-money laundering rules. If you’re a non-financial entity - meaning you’re not a bank or licensed fintech company - and you conduct a crypto transaction of MXN $60,000 or more (about $3,500 USD), you must report it to the Ministry of Finance. This applies to individuals too. If you sell $4,000 worth of crypto in one transaction, your exchange might report it. If you cash out $3,600 in cash at a P2P kiosk, you could be flagged. The goal is to catch illicit activity, but it also means even small-time traders need to be aware of their transaction history. Financial institutions (banks, licensed exchanges) face even stricter rules. They need authorization from Banco de México to handle crypto - and even then, they can’t offer crypto services to the public. That’s why most Mexican users trade through international exchanges like Binance or Kraken, which aren’t regulated locally.What’s Not Covered - And Why It Matters

There’s no official guidance on:- Hard forks (what if you get new coins from a blockchain split?)

- Gifts or inheritances of crypto

- Losses from hacked wallets or scams

- How to handle crypto used for business expenses

How Mexico Compares to Neighbors

Mexico’s approach is middle-of-the-road in Latin America. El Salvador made Bitcoin legal tender in 2021, but as of January 2025, it’s no longer mandatory - and now subject to standard capital gains tax. Argentina offered a crypto tax amnesty through March 2025, letting people declare hidden holdings without penalty. Brazil taxes crypto gains at 15% for individuals, with exemptions for small trades. Mexico’s 35% top rate is high. But the $4,000 USD exemption helps low- to middle-income users. The real burden falls on active traders and businesses. Unlike Brazil or Colombia, Mexico doesn’t have a clear, simplified regime for retail investors. You’re stuck navigating general tax law with no crypto-specific road map.What You Should Do Now

If you’re using crypto in Mexico, here’s what to do:- Track every transaction - buys, sells, trades, spends - with dates and peso values.

- Calculate your annual gains. If you’re under MXN $90,000, you’re likely safe.

- If you’re over the exemption, calculate your total income to find your tax bracket.

- Use a reliable crypto tax tool that supports Mexican peso conversions.

- Keep records for at least five years - the statute of limitations for tax audits.

- Consult a tax professional familiar with both Mexican tax law and crypto.

What’s Next for Crypto Tax in Mexico?

There’s no sign of major reform. President Claudia Sheinbaum hasn’t made crypto a priority. The ruling Morena Party has only made small amendments to existing laws - like adding crypto gains to taxable income - not creating a new system. Experts predict two paths: either Mexico will tighten enforcement and demand better reporting, or it will eventually create a simplified regime for retail users. For now, the system is fragmented, unclear, and risky. But it’s not going away. Crypto is here to stay. So is the taxman.If you’re in Mexico and using crypto, your best move is to treat it like any other asset. Keep records. Know your numbers. Don’t assume you’re invisible. The authorities are watching - even if they haven’t told you yet.

Do I pay tax if I just hold crypto in Mexico?

No. Holding cryptocurrency without selling, trading, or spending it does not create a taxable event in Mexico. Taxes are only triggered when you realize a gain - meaning you convert crypto to fiat, trade it for another crypto, or use it to pay for goods or services.

Is crypto-to-crypto trading taxable in Mexico?

Yes. Trading one cryptocurrency for another - like Bitcoin for Ethereum - is treated as a sale of the first asset and a purchase of the second. You must calculate the fair market value in Mexican pesos at the time of the trade and report any capital gain or loss.

What’s the tax exemption for individuals in Mexico?

Mexican individuals have an annual exemption of up to MXN $90,000 (about $4,000 USD) on capital gains from movable property, including cryptocurrency. If your total crypto gains for the year are below this amount, you don’t owe income tax on them.

Do I need to report crypto transactions to the government?

Yes, if the transaction value is MXN $60,000 or more (about $3,500 USD), you must report it under anti-money laundering rules. This applies to individuals and businesses alike. Financial institutions must also report all crypto activity, regardless of size.

How are mining rewards taxed in Mexico?

Mining rewards are treated as income when received. You must record the fair market value of the mined cryptocurrency in Mexican pesos on the day you received it. That amount becomes part of your taxable income for the year.

Can I deduct crypto losses in Mexico?

The Mexican tax code does not clearly allow deductions for crypto losses from hacks, scams, or market declines. While you can offset gains with losses from other crypto sales, losses from non-sale events (like stolen wallets) are not recognized. Consult a tax advisor before claiming any loss.

What’s the corporate tax rate on crypto profits in Mexico?

All legal entities in Mexico pay a flat 30% corporate income tax on crypto profits, regardless of how long the asset was held. There are no preferential rates for long-term holdings or exemptions.

Do I need to file a tax return if my crypto gains are under MXN $90,000?

You still need to file a tax return if you’re required to do so based on your other income. The exemption means you won’t pay tax on crypto gains below MXN $90,000, but you must still report them in your annual tax filing to prove you’re within the exemption limit.

Comments

So let me get this straight - if I buy Bitcoin and never touch it, I’m fine? But if I use it to buy coffee, the government wants a cut? 🤡 This is why I’m not even bothering with crypto in Mexico. They’re just trying to tax the air I breathe now.

Also, who’s keeping track of every single swap? I’m not a spreadsheet wizard. I just want to buy NFTs and chill.

They’re gonna come for my Dogecoin next. Mark my words.

Wow this is super helpful! I didnt even know crypto was taxed like this in mexico. I just thought if you dont cash out you dont pay tax. But now i see even trading btc for eth is a sale??

Im gonna start using a tracker app right away. thanks for breaking this down so simple! 🙏

Let me stop you right there. This whole ‘exemption’ thing is a trap. The SAT doesn’t care if you’re under 90k - they’ll audit you anyway if you’re on Binance. And guess what? They’ll assume you’re hiding income because you didn’t report every single satoshi.

And don’t even get me started on airdrops. You think you got free tokens? Nah. You just got a tax liability you didn’t ask for. This system is designed to scare people out of crypto - not help them comply.

They’re not here to help. They’re here to catch you.

It’s fascinating how we’ve created this entire digital economy - decentralized, borderless, permissionless - and then slapped it with 19th-century tax logic.

We treat crypto like property, but it behaves like money. We demand cost basis tracking for every swap, but refuse to define what ‘fair market value’ means when a token has no liquidity.

Is this taxation… or is it control dressed up as bureaucracy? The state doesn’t trust us to manage our own wealth, so it invents rules that are impossible to follow - then punishes us for failing.

Maybe the real question isn’t ‘how do I pay less tax?’ but ‘why should I play by rules that don’t recognize the reality I live in?’

And yet… we keep buying. Because freedom is messy. And so is tax law.

Thanks for this super clear breakdown! 🙌 I’ve been trading on Binance for a year and never knew about the MXN 90k exemption - that’s a game changer for casual holders!

Also, using CoinMarketCap for peso conversions? Genius. I was using random sites and now I know I’m risking an audit. 🤦♂️

Just started a Notion tracker for all my trades - wish I’d done this sooner. You’re a lifesaver! 💪

LOL. You people think this is bad? Try living in the U.S. where you pay tax on every damn trade - even if you lose money. At least Mexico gives you a 90k exemption. Most countries don’t even have that.

And yes, mining rewards = income. Duh. You think the IRS or SAT is gonna let you mine free money? Wake up. This isn’t a game. You’re running a business.

Stop whining. Track your shit. Pay your taxes. Or get out of crypto. Simple.

Okay, but if you’re using crypto to pay for groceries, you’re literally helping the economy. Why is that taxable? You’re not making money - you’re just spending it like cash.

And what if you bought ETH for $20k and sold it for $18k? You lost money, but you still pay tax? That’s insane. The government is punishing people for trying to be financially independent.

Also, who’s gonna audit a guy who uses 3 wallets and 2 exchanges? They can’t even track their own budget. 😏

so like… i just traded 1 btc for 25 eth last week and then bought a couch with it and now i think i owe taxes??

i dont even know how to spell ‘capital gain’ and my bank account is at 12 pesos 😭

can i just say i lost it all to hackers? plz?

Y’all are making this way harder than it needs to be! 😊 I’m not a tax pro but I’ve been doing crypto since 2021 and here’s what I do:

I use Koinly, set it to MXN, and let it auto-import from Binance. It calculates everything - gains, losses, income from staking - and spits out a report. I print it, file it with my other income, and boom - done.

And yes, the 90k exemption is real. I made 75k last year from trading and paid zero. I even celebrated with tacos 🌮

Don’t stress. Just track. Use tools. Ask questions. You got this!

And if you’re worried about audits? Keep your records for 5 years. I keep mine in Google Drive with labeled folders. Easy peasy!

This is a joke. Mexico has no right to tax digital assets. It is not even a real currency. The government is just trying to squeeze money from people who are smart enough to use crypto.

Why don’t they fix the peso first? Then worry about Bitcoin.

OMG thank you so much for this!! I was so confused about airdrops - I got some $BONK last month and thought it was free money 😅

Now I know I have to record the value in pesos on the day I got it. I’m gonna check CoinGecko and log it tonight.

Also, the 90k exemption is a lifesaver - I only made 40k last year from trading, so I’m safe! 😊

Anyone else use CoinTracker? It’s got a Mexican peso option too!!

Let’s be real - this whole ‘exemption’ is a lie. The SAT doesn’t care about your 90k. They’ll audit you if you’re on Binance. And they’ll assume you’re hiding 500k in crypto because you didn’t report a single trade.

And don’t even think about using DeFi. They’re coming for yield farmers next. This isn’t taxation. It’s surveillance with a tax form.

They want you to be afraid. And you should be.

Mexico has no business taxing crypto. The peso is garbage. The government is corrupt. Why should I pay them for using a technology that actually works?

This is not a tax policy. It’s a power grab.

And you call this freedom?

Thanks for writing this. It’s rare to see such a clear breakdown of crypto taxes in Mexico. I’ve been helping friends navigate this and I keep pointing them here.

One thing I’d add: if you’re unsure about a transaction, don’t guess. Document your reasoning - even if it’s just a note saying ‘I used Binance’s price on X date because it was the most liquid.’ That’s enough to show good faith.

And if you’re feeling overwhelmed - you’re not alone. We’re all figuring this out as we go. Just keep moving forward.

wait so if i trade btc for usdt and then usdt for eth is that two taxable events?? i think i did that last week and now my head hurts

also i think i spelled 'basis' wrong in my notes 😅

Oh please. You’re all acting like this is the first time a government tried to control money.

Gold was taxed. Barter was banned. Digital cash? Of course they’re coming for it.

The real revolution isn’t crypto - it’s refusing to play their game. Don’t report. Don’t track. Don’t care.

Let them audit the 3% who follow the rules. The rest of us? We’re already free.

And for the record - if you’re using DeFi, you’re not ‘investing.’ You’re running a financial business. That means you’re responsible for every transaction, every gas fee, every flash loan.

Stop pretending this is ‘passive income.’ It’s not. You’re the CEO of a one-person bank.

And if you don’t want to file taxes? Then don’t touch DeFi. Simple.