Learn how a 51% attack enables double-spending, see real-world examples, understand why big blockchains are safe, and discover how to detect and prevent these attacks.

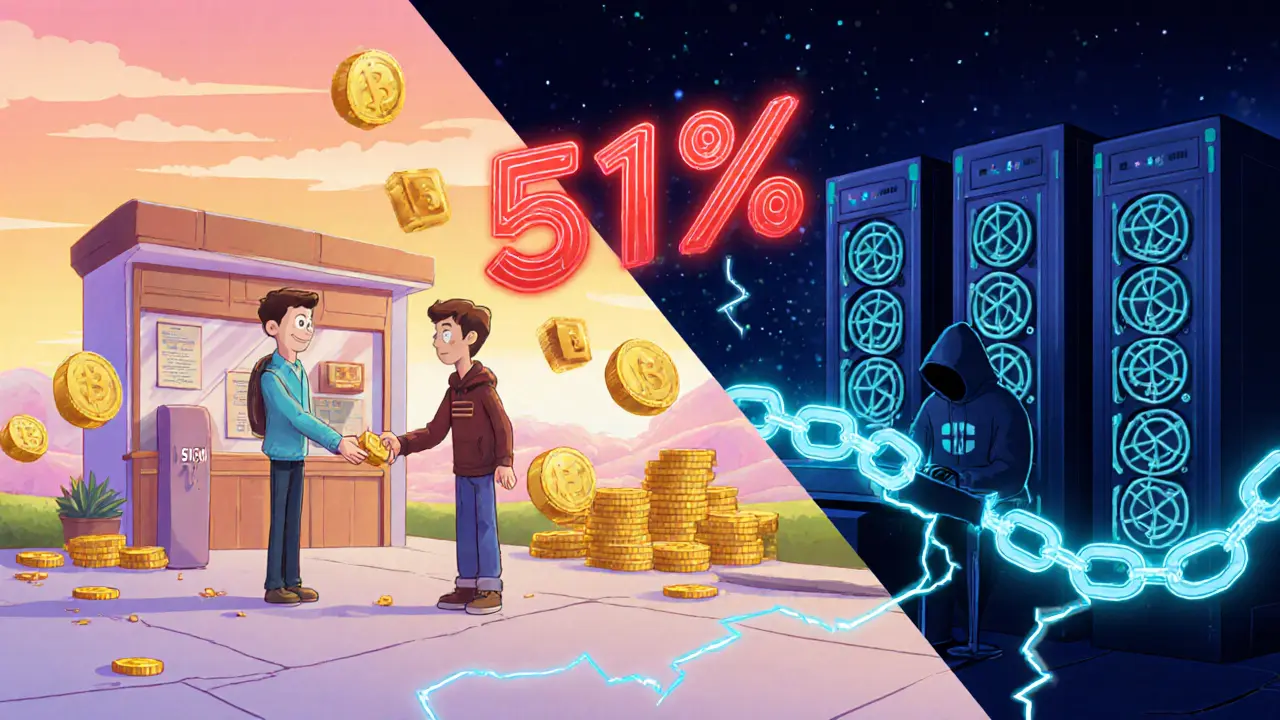

51% Attack: What It Is and Why It Matters

When working with 51% attack, a scenario where a single miner or pool controls more than half of a blockchain’s hashing power, allowing them to rewrite recent blocks and disrupt consensus. Also known as majority attack, it poses a serious threat to any proof‑based network. In plain terms, if someone grabs the majority of the network’s work, they can decide which transactions stay and which disappear. That power opens the door to fraud, lost funds, and shaken confidence in the whole system.

Key Concepts Behind a 51% Attack

The heart of the problem lies in blockchain consensus, the rule set that tells every node which block is the true one. When the majority of miners follow a different rule, the consensus breaks down and the attacker can push an alternative chain. The more decentralized the mining power, the harder it is for any single group to reach that critical 50% threshold.

One of the most obvious abuses is the double spend, a trick where the attacker spends the same coins twice by reverting a transaction on the original chain. Imagine buying a game, then using a 51% attack to erase that purchase and keep the money. The victim ends up with nothing while the attacker walks away with both the game and the cash.

The difficulty of pulling off a 51% attack depends heavily on the underlying proof of work, the computational puzzle miners solve to add new blocks. In PoW systems, the attacker must own enough hardware to outpace the rest of the world’s miners, which can be cost‑prohibitive for large, well‑established networks. Smaller chains with low hash rates, however, become easy targets because the hardware investment is relatively modest.

Proof‑of‑stake (PoS) introduces a different dynamic: instead of computing power, the attacker needs to own a majority of the staked tokens. While the math changes, the core idea remains—control enough of the consensus resource and you can manipulate the ledger. PoS networks often add extra safeguards like slashing penalties, which make attacks financially risky.

So, how can a community protect itself? First, encourage a broad, distributed set of miners or validators. The more participants, the higher the cost for anyone trying to dominate. Second, implement checkpointing or finality gadgets that lock in blocks after a certain depth, making it impossible to rewrite history beyond that point. Third, monitor hash‑rate fluctuations and set alerts for sudden spikes that could signal an impending takeover.

Real‑world history shows the impact. In 2018, Bitcoin Gold fell victim to a 51% attack that erased over $18 million in transactions. Later, Ethereum Classic experienced a similar breach, prompting a hard fork to re‑secure the chain. These events underline that even well‑known projects aren’t immune if their mining pools become too concentrated.

Understanding the mechanics behind a 51% attack helps you spot warning signs and choose safer assets. Below you’ll find a curated set of articles that dive deeper into security risks, token‑specific analyses, and step‑by‑step guides on protecting your portfolio from majority‑control threats. Explore the collection to sharpen your knowledge and stay ahead of potential attacks.