Understanding blockchain finality is crucial for secure transactions. This guide compares probabilistic, deterministic, economic, and Layer 2 finality models across Bitcoin, Ethereum, Solana, and more-helping you choose the right chain for your needs.

Deterministic Finality in Blockchain: What It Means and Why It Matters

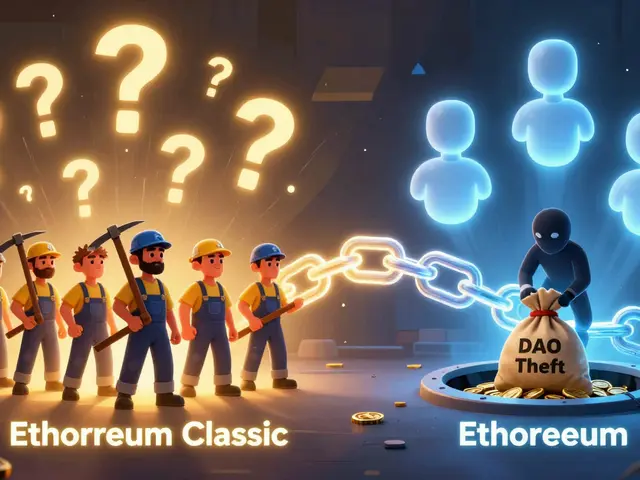

When you send crypto, you need to know it’s final—not just confirmed, but truly done. That’s where deterministic finality, a property of some blockchain networks where transactions are irreversibly settled after a fixed number of blocks. It’s not just "confirmed"—it’s locked in, no matter what. Unlike proof-of-work chains like Bitcoin, where finality is probabilistic and grows stronger over time, deterministic finality means once a block is added, there’s no going back. No 51% attacks, no chain reorgs, no uncertainty. It’s built into the protocol’s rules.

This isn’t just theory—it’s what makes DeFi, cross-chain swaps, and institutional crypto adoption possible. Protocols like Tendermint, a consensus engine used by Cosmos and other high-speed blockchains rely on deterministic finality to guarantee that trades settle instantly. Similarly, Polkadot’s BABE and GRANDPA, a hybrid consensus combining block production and finality voting ensure that parachain transactions are confirmed and final within seconds. These aren’t marketing buzzwords—they’re engineering choices that eliminate the waiting game. If you’re trading derivatives on Kwenta, swapping tokens on SwapX, or even just holding assets on a chain that doesn’t offer this, you’re exposed to delays and risks that deterministic finality removes.

Why does this matter to you? Because if a blockchain can’t guarantee finality, your transaction might look done—but it’s not. You could lose funds to a reorg. A DEX might show your trade as complete, then reverse it hours later. That’s why platforms like Block DX and Firebird Finance prioritize chains with strong finality—they’re not just about low fees, they’re about trust. And when you’re dealing with real money, trust isn’t optional. The posts below dive into real-world examples: how SwapX leverages concentrated liquidity with deterministic finality on Sonic, why Algebra Exchange is dangerous because it runs on chains without it, and how Quoll Finance’s lack of transparent finality makes it a relic. You’ll also see how regulatory bodies in Thailand and the Philippines are starting to require this as a baseline for licensed exchanges. This isn’t just for developers. It’s for every trader, holder, and user who wants to know their crypto is truly safe.