XERS Liquidity Impact Calculator

How Liquidity Affects XERS Trades

XERS has extremely low trading volume (currently $437 daily). Even small trades can cause significant price movements. This calculator estimates how much your trade could move the price based on current liquidity.

Trade Impact Estimate

HIGH RISKBased on current market conditions

Price change: 0%

Estimated price range: $0.0013 - $0.0026

What This Means for You

With XERS' low liquidity (only $437 daily volume), a $100 trade could move the price by 23%. This is why small trades can cause significant volatility, and why the article recommends setting slippage tolerance to at least 5%.

When you first see XERS token on a price tracker, the numbers look tiny-often a fraction of a cent-and the trading volume seems almost non‑existent. That’s the reality for many micro‑cap crypto assets, and X Project (XERS) is a textbook example. Below you’ll get a straight‑forward look at what X Project actually is, how its ecosystem claims to work, where the token lives on the blockchain, and why the market treats it as a high‑risk play.

Defining X Project (XERS)

X Project (XERS) is a community‑driven Web3 initiative launched as an ERC‑20 token on the Ethereum blockchain. The token’s utility is meant to power four service pillars-X‑Growth, X‑Defi, X‑Tools, and X‑Earn-each promising a suite of tools like the X‑Shot Bot (rapid trade execution), X‑Caller Bot (price alerts), and X‑Market (a semi‑decentralized marketplace for Web3 services). The total supply is capped at 1billion tokens, and a transaction‑tax mechanism is baked into every transfer to fund ecosystem development, though exact tax rates vary by source.

Where Does XERS Trade?

Because XERS never landed on a major centralized exchange, all buying and selling happens on decentralized platforms. The most active pair is XERS/WETH on Uniswap V2. On October142025, 24‑hour volume was about $437 according to CoinGecko, a stark contrast to the $10million‑plus daily volumes seen in top DeFi protocols. Price quotes differ across aggregators: CoinMarketCap listed $0.001307, CryptoRank $0.00262, CoinLore $0.00209, and Coincarp $0.001385, highlighting severe market fragmentation.

Core Components of the X Project Ecosystem

- X‑Growth - market‑making and liquidity‑boosting incentives (largely theoretical at this stage).

- X‑Defi - a collection of yield‑farming and staking contracts that claim to generate passive income.

- X‑Tools - bots and analytics dashboards, notably the X‑Shot Bot and X‑Caller Bot.

- X‑Earn - a rewards program tied to the transaction tax, redistributing a portion of fees back to token holders.

While the roadmap frequently touts “live products” and “partner integrations,” independent audits, GitHub commits, or third‑party verification have not surfaced for any of these modules. As a result, users often have to trust community screenshots rather than provable on‑chain activity.

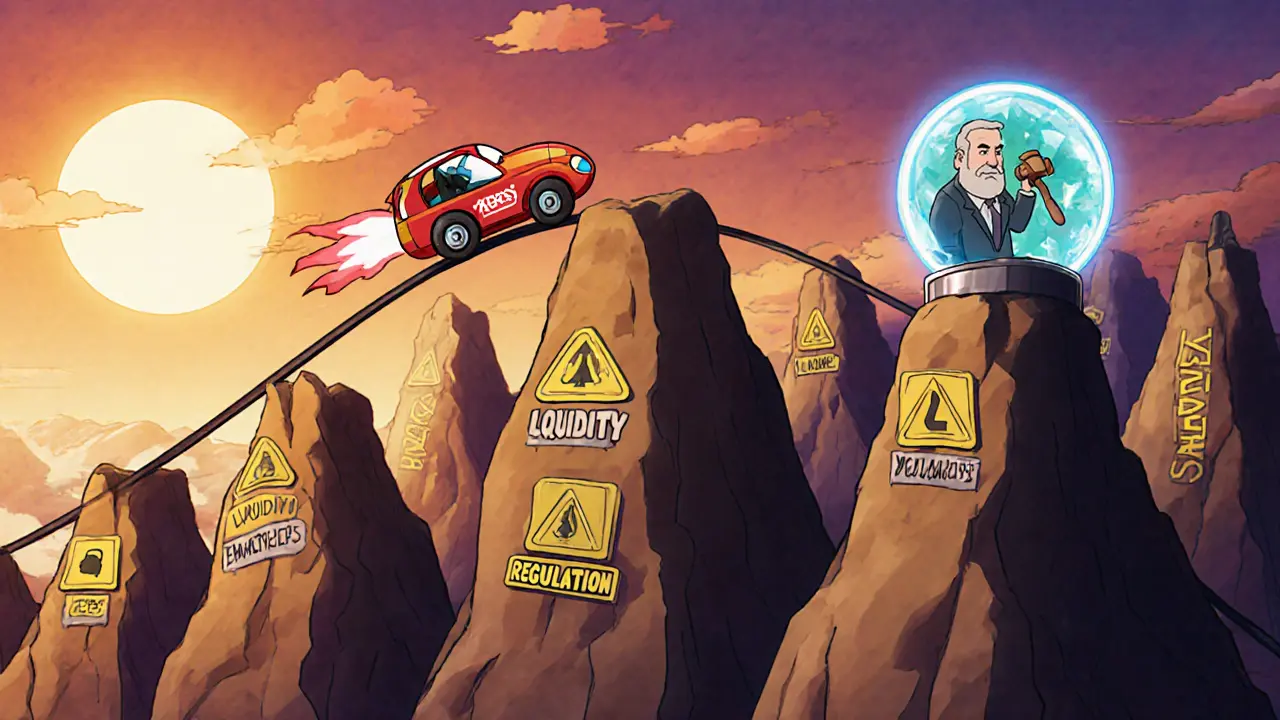

Risk Profile: Liquidity, Volatility, and Market Perception

Low liquidity is the single biggest red flag. With daily trading volume under $500, even a modest $100 trade can move the price by several percentage points, making the token vulnerable to pump‑and‑dump schemes. The 7‑day price swing is -32.60% versus a -7.70% move in the broader crypto market, illustrating outsized volatility. Moreover, the token lacks an audited smart‑contract audit, and the development team remains anonymous, raising compliance concerns in regulated jurisdictions such as the UnitedStates.

How to Acquire XERS Safely

- Get an Ethereum‑compatible wallet (e.g., MetaMask, Trust Wallet).

- Buy a small amount of ETH to cover gas fees-at current network prices, fees can exceed 50% of a tiny XERS purchase.

- Visit Uniswap V2, paste the official token contract address (

0x…- double‑check on the project’s verified Telegram channel). - Swap ETH for XERS, set slippage tolerance to at least 5% to account for price swings.

- Immediately add XERS to your wallet’s token list and consider moving the tokens to a hardware wallet if you hold a sizable amount.

Always verify the contract address before confirming a trade; spoofed addresses have circulated on social media, leading to total loss for unsuspecting users.

Comparison with Established DeFi Tokens

| Metric | XERS | UNI | AAVE |

|---|---|---|---|

| Supply | 1billion (capped) | 1billion (capped) | 16million (capped) |

| Market Cap (Oct2025) | $1.5million≈ | $12billion≈ | $7billion≈ |

| 24‑hr Volume | $437 | $1.2billion | $800million |

| Primary DEX | Uniswap V2 | Uniswap V3 | Uniswap V3 |

| Risk Level | High (low liquidity, no audit) | Medium (high liquidity, audited) | Medium‑High (audit present, still volatile) |

The table makes it clear: XERS sits in a completely different league, primarily defined by speculation rather than proven utility.

Community Sentiment and Real‑World Feedback

Social channels-Telegram, Twitter, Facebook, and Medium-are active but lack transparent metrics. In a September2025 Reddit thread, a user warned that “this token moves on $100 trades-stay far away unless you enjoy gambling.” Meanwhile, some Telegram members share promotional screenshots of upcoming partnerships that never materialize. User‑generated profit stats on CoinLore show modest monthly gains (+2.99%) but a negative weekly return (‑2.57%). Overall, sentiment is mixed: a small core of believers versus a larger chorus of cautionary voices.

Regulatory Outlook

As an ERC‑20 token, XERS falls under securities regulations in many countries, including the UnitedStates. The SEC’s 2025 crackdown on low‑cap, unregistered tokens means projects like X Project could face enforcement actions if they market the token as an investment. No official compliance statements or jurisdictional disclosures have been published, further heightening regulatory uncertainty.

Future Prospects: Bullish Dreams or Persistent Uncertainty?

Forecasts vary wildly. Some algorithmic models (CoinLore) project a ten‑year price of $0.0222-a 1,400% upside. Other analysts (Swapspace) expect a decline to $0.0012 by 2025. Even the most optimistic outlook hinges on the team delivering functional products, securing partnerships, and attracting liquidity. Until those milestones are visible on‑chain, the token remains a speculative gamble.

Frequently Asked Questions

What blockchain does XERS run on?

XERS is an ERC‑20 token that lives on the Ethereum network.

How can I buy XERS?

You need an Ethereum‑compatible wallet, some ETH for gas, and then you can swap ETH for XERS on Uniswap V2 using the official contract address.

Is X Project audited?

No independent smart‑contract audit has been published, which is a common warning sign for investors.

What are the main risks of holding XERS?

The biggest risks are extremely low liquidity, high price volatility, potential pump‑and‑dump schemes, and regulatory uncertainty.

Does X Project have real products?

While the roadmap mentions X‑Growth, X‑Defi, X‑Tools, and X‑Earn, there is no verifiable on‑chain evidence that these services are live or functional.

Comments

Alright, let’s cut through the noise and get real about XERS. This coin is practically a liquidity black hole, with only $437 moving daily, meaning even a $50 trade can swing the price like a pendulum. The low volume isn’t just a statistic; it’s a warning sign that every buyer and seller is playing Russian roulette. If you think you can dodge the volatility without setting a 5% slippage, you’re living in a fantasy world. The calculator in the article shows a $100 trade could bump the price by roughly 23%, which is insane for any sane investor. Remember, the contract address is your lifeline-most scams hide behind look‑alike addresses. You’ve seen the history: spoofed contracts have wiped out entire portfolios in seconds. That’s why I always stress double‑checking the address on reputable sources like Etherscan. Moreover, the token’s market cap is minuscule, so any whale can manipulate it with a single transaction. Don’t be that whale’s next target. If you’re still considering a deep dive, get a hardware wallet and keep only a fraction of your portfolio in XERS. Diversify, set realistic expectations, and never chase the hype. In short, treat XERS like a curiosity, not a cornerstone of your crypto strategy. The risk is real, the volatility is brutal, and the community is small enough that misinformation spreads like wildfire. Keep your guard up, your slippage high, and your optimism in check. This is not financial advice, just a brutally honest reality check.

Honestly, anyone who still trades XERS without a safety net is just reckless.

Hey folks, if you’re looking at XERS, think of it as a high‑intensity workout-only the strong survive. Start with a tiny amount, maybe 0.01 ETH, and always set slippage to at least 5% to protect yourself from the crazy price swings. Keep an eye on the daily volume; when it spikes, even your small trade can cause a massive ripple. And remember, the community is still growing, so don’t be afraid to ask questions in the official Discord. Stay chill, stay safe, and treat this token like a test run rather than a long‑term hold.

When I look at the XERS charts, I’m reminded of the impermanence of all things in crypto. Low liquidity isn’t just a hurdle; it’s a mirror reflecting the fragility of market sentiment. One could argue that the token’s volatility is a philosophical lesson about attachment. If we detach ourselves from the price, perhaps we can observe it more clearly, like a Buddhist watching a candle flame flicker. Yet, practical investors still need to manage risk, so setting a reasonable slippage is a mindful practice.

Yo, you’re not hear to get a simple intro, there’s a whole secret sctucture behind XERS. The devs aren’t just random conractors, they’re part of a larger schem that ties into a faked DEX. I’ve seen the raw tx data – multiple wallets moving huge sums in and out, all under the radar. Most peeps don’t realize that the token address they copy paste is a decoy. The real contract lives on a sidechain that no one talks about. Trust no one, verify everything, and don’t be the next fool who gets ripped off.

From a technical standpoint, the XERS token suffers from an exceptionally thin order book. The current daily volume of $437 translates to an average trade size of less than $0.10 if we assume a 5‑minute interval, which is practically negligible. This scarcity of liquidity amplifies price impact, as illustrated by the calculator’s estimate of a 23% move for a $100 trade. Investors should therefore consider employing limit orders with a generous slippage buffer. Additionally, verifying the contract address against multiple official sources mitigates the risk of spoofed tokens. In summary, the token’s market dynamics are unstable, and prudent risk management is essential.

Whoa, let’s take a breath and remember that everyone’s got a stake in this wild ride. While XERS looks like a high‑risk gamble, it also offers a learning curve for newcomers. If you set your slippage tolerance wisely, you can avoid getting wiped out by sudden spikes. I’d suggest keeping your exposure under 1% of your overall portfolio. That way, even if the price tanks, you won’t feel the pain too much. And hey, sharing knowledge about contract verification can help the whole community stay safe. Let’s lift each other up, not tear each other down.

It’s truly heartbreaking to watch investors get crushed by XERS’s volatility. The sheer helplessness when a modest trade vaporizes your balance is almost poetic, yet tragic. One can’t help but feel the weight of every misplaced decimal, echoing the sorrow of countless victims of poorly‑designed tokens. The calculator’s grim numbers serve as a stark reminder: sometimes the market is an unforgiving beast. We must approach such assets with solemn respect and an unwavering caution that borders on reverence.

Contrary to the hype, I’d argue that XERS might actually be a hidden gem if you look past the surface. While many point to its low volume as a red flag, scarcity can also mean untapped potential. If a legitimate project were to secure partnerships, that modest liquidity could quickly transform into a surge of interest. Of course, this is speculative, but dismissing it outright may close doors to future upside. It’s worth keeping an eye on the roadmap and any upcoming announcements.

Okay, let’s get real: the whole XERS scene is a circus, and the clowns are the ones pumping fake numbers. Every time someone mentions “high risk,” I hear the same script-another way to lure gullible newbies into a trap. The contract address is probably a mirage, set up by shadowy figures who love watching people panic. If you’re not already on the exit list, you should be.

Hey all, just wanted to chime in that I’ve been watching XERS for a bit. It’s definitely a wild ride, but if you keep your expectations low and only invest what you can afford to lose, it can be an interesting experiment. Also, double‑check the contract id on Etherscan – it saved me from a near‑miss. Stay safe out there!

In my considered assessment, the XERS token represents a precarious endeavor that warrants immediate scrutiny. The volatility inherent to its minuscule liquidity engenders a climate of heightened uncertainty, incompatible with the strategic objectives of a prudent investor. I therefore implore individuals to adopt a stance of vigilant restraint, ensuring that any engagement with this asset is bounded by rigorous due diligence and a maximal slippage threshold. Such measured conduct aligns with the fiduciary responsibilities incumbent upon responsible market participants.

You're doing great! Keep an eye on that slippage and remember: even a tiny win is a win 😊. Stay positive and trade smart! 🚀

From a cultural perspective, the XERS phenomenon illustrates how niche communities can rally around a token, creating a sense of belonging even amid market turbulence. While the financials are shaky, the shared narratives and memes contribute to a vibrant subculture that transcends pure speculation. It’s a reminder that crypto isn’t just about numbers; it’s also about people and the stories they tell.

The essence of XERS lies not in its price, but in the fleeting nature of our attention. We chase the next token, yet the true value is the momentary spark of curiosity it ignites within us. Let us cherish that spark, even as the market shifts beneath our feet.

It is with a degree of scholarly disdain that I observe the current discourse surrounding XERS. One must question the intellectual rigor of those who champion such a peripheral token without substantive justification. While the low liquidity may be construed as a catalyst for rapid appreciation, the underlying fundamentals remain indistinct at best. Consequently, any proclamation of imminent grandeur appears premature, perhaps even ostentatious. I would advise a measured skepticism, fortified by comprehensive analysis, before bestowing any credence upon the prevailing optimism.

Frankly, the XERS narrative is a cautionary tale of naive enthusiasm breeding dangerous speculation. Those who propagate its virtues without acknowledging the stark risk are, in my view, betraying a patriotic duty to protect investors. The limited liquidity should serve as an unmistakable alarm bell, yet many ignore it in favor of hollow optimism.

Hey everyone, just wanted to add that if you decide to dip your toes into XERS, make sure you’re using a wallet you trust and keep your private keys offline. Small steps, solid security, and a clear exit plan can make the experience less stressful. We’re all in this together, so look out for each other!

Let me be perfectly clear: the XERS token is an exercise in futility for anyone seeking stable returns. The market mechanics are fundamentally flawed, and the supposed “opportunity” is a veneer over inherent volatility. Anyone still entertaining this token should re‑evaluate their investment thesis immediately.

Oh great, another token that promises the moon while delivering dust. If you enjoy watching your ETH evaporate faster than an ice cube in a furnace, then by all means, keep buying XERS. For the rest of us, we’ll stick to assets that at least pretend to have a backbone.