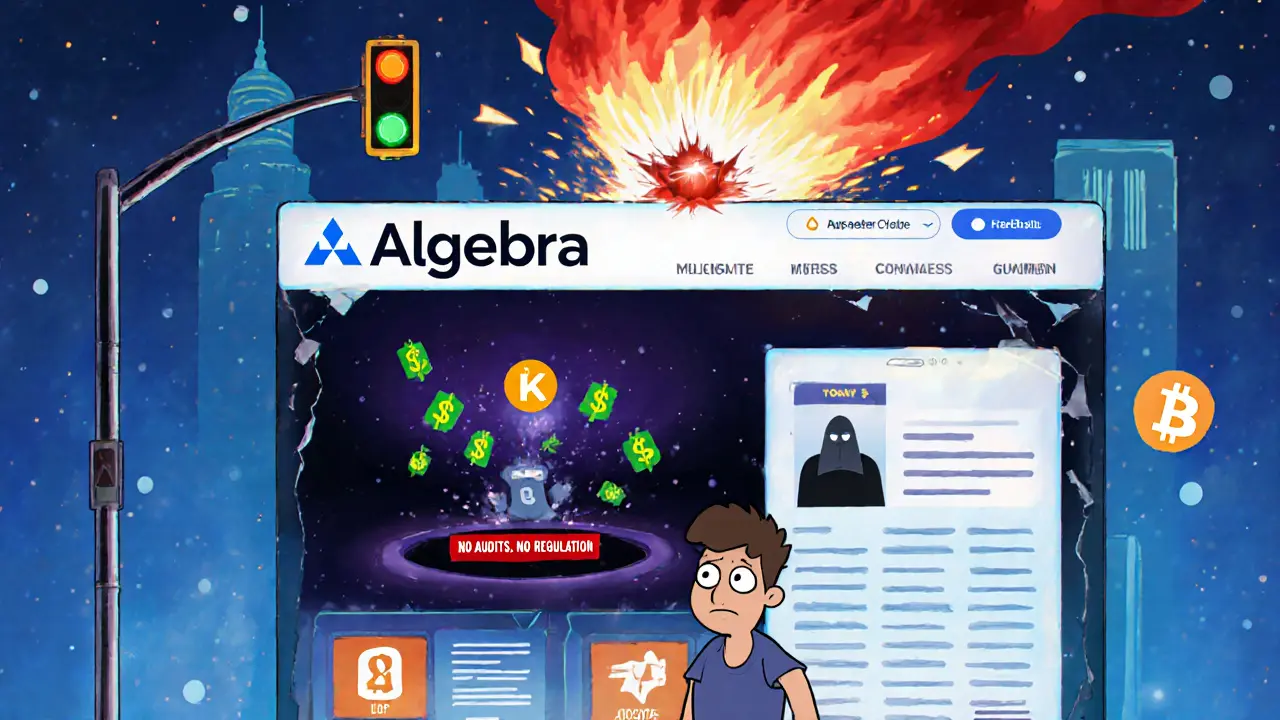

Algebra crypto exchange lacks transparency, regulation, and security proof. With no audits, no user reviews, and no legal registration, it's too risky to use. Stick to trusted platforms instead.

Algebra Exchange Security: What You Need to Know About Decentralized Exchange Risks

When you trade on a decentralized exchange, a crypto trading platform that runs on blockchain without a central operator. Also known as DEX, it lets you swap tokens directly from your wallet—no KYC, no middleman. But that freedom comes with a catch: if the code has a flaw, or the liquidity pool gets drained, there’s no customer support to call. Algebra Exchange, like many newer DEXs, promises lower fees and better yields—but security isn’t just about smart contracts. It’s about who audited them, how much liquidity is locked, and whether the team is even visible.

Most DEXs fail not because of hackers, but because of neglect. Take SwapX, a DEX on the Sonic blockchain using concentrated liquidity and ve(3,3) tokenomics—it’s built for efficiency, but if no one’s watching the pools, your tokens vanish. Same goes for RadioShack Swap, a Polygon-based DEX with thin liquidity and conflicting on-chain data. These aren’t edge cases. They’re the norm. A 2024 Chainalysis report found that 78% of new DEXs had zero third-party audits within their first six months. That’s not innovation—that’s gambling with your private keys.

Security on a DEX isn’t about flashy UIs or big token rewards. It’s about transparency. Did the team publish the source code? Is the liquidity locked with a reputable vesting contract? Are the tokenomics designed to prevent rug pulls? Look at Block DX, a fully decentralized exchange that operates without KYC or custodial wallets. It doesn’t have a mobile app or viral marketing—but it’s been live for years because it never promised more than it delivered. Meanwhile, platforms like AladiEx, a crypto exchange lacking audits and regulatory info, rely on hype to attract users before disappearing.

Algebra Exchange security isn’t a feature you turn on. It’s the result of constant scrutiny, open code, and real accountability. If a DEX won’t show you its audit reports, or hides its team behind anonymous wallets, it’s not secure—it’s a waiting room for a scam. The posts below break down exactly how these platforms work, where they go wrong, and which ones you can actually trust. You’ll see real examples of failed DEXs, how liquidity traps form, and what red flags to spot before you deposit a single coin.