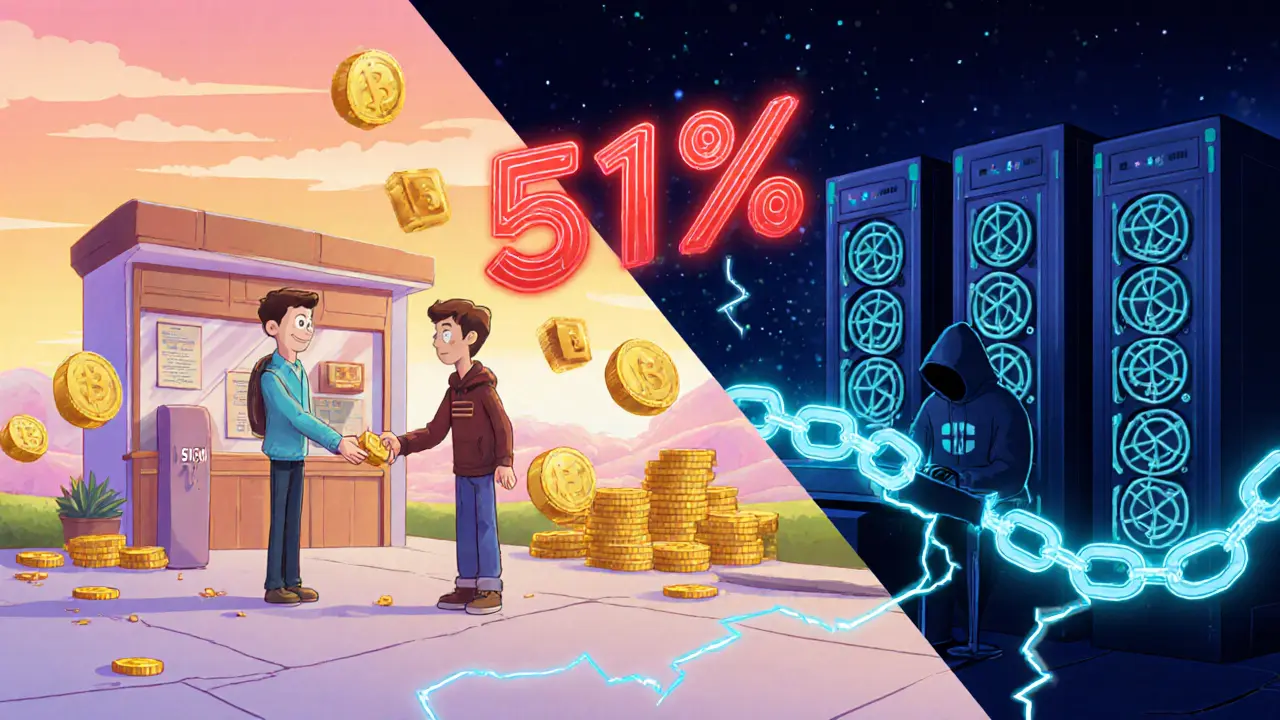

Learn how a 51% attack enables double-spending, see real-world examples, understand why big blockchains are safe, and discover how to detect and prevent these attacks.

Double‑Spending: What It Is and Why It Matters

When working with double‑spending, the attempt to use the same cryptocurrency unit in more than one transaction. Also known as double spend attack, it exploits flaws in transaction validation, network latency, or weak custody controls. The threat hinges on three core pieces of blockchain security: digital signatures, cryptographic proofs that a sender indeed authorized a transaction, the PBFT consensus, a practical Byzantine Fault Tolerance algorithm that orders transactions in permissioned networks, and the way centralized exchanges handle user funds under custodial control. In simple terms, if a signature can be forged, PBFT can be subverted, or a custodial service fails to lock funds, a malicious actor can spend the same coins twice. This triple relationship—signature ➜ consensus ➜ custody—forms the backbone of any double‑spending scenario.

Why Double‑Spending Still Pops Up in 2025

Even with mature protocols, double‑spending shows up where security gaps exist. On public blockchains, attackers may flood the network with conflicting transactions, hoping a slower node accepts the fraudulent one before the legitimate copy propagates. PBFT‑based private chains mitigate this by requiring a super‑majority of agreeing nodes, but they’re not immune to collusion or compromised validators. Meanwhile, centralized exchanges create a fertile ground for double‑spending when users trade without proper settlement checks. If an exchange’s internal ledger isn’t synchronized with the underlying blockchain, a user could withdraw funds, initiate a second withdrawal, and exploit the timing lag. Recent reports on exchange token risks, custodial hacks, and operational failures highlight how a weak custody layer can turn a normal transaction into a double‑spend opportunity. Moreover, regulatory actions like OFAC sanctions on illicit networks remind us that compliance failures can hide double‑spending vectors within complex money‑laundering schemes. Understanding these dynamics helps you spot red flags—unusual transaction speeds, mismatched block confirmations, or exchange‑level inconsistencies—before a loss occurs.

The articles below dive deep into each of these angles. You'll find a breakdown of digital signature vulnerabilities, a step‑by‑step guide to PBFT consensus, real‑world case studies of exchange security lapses, and practical tips for protecting your assets against double‑spending attacks. Whether you're a trader, developer, or just curious about crypto safety, the collection gives you the tools to recognize and prevent the most common double‑spending tricks in today’s market.