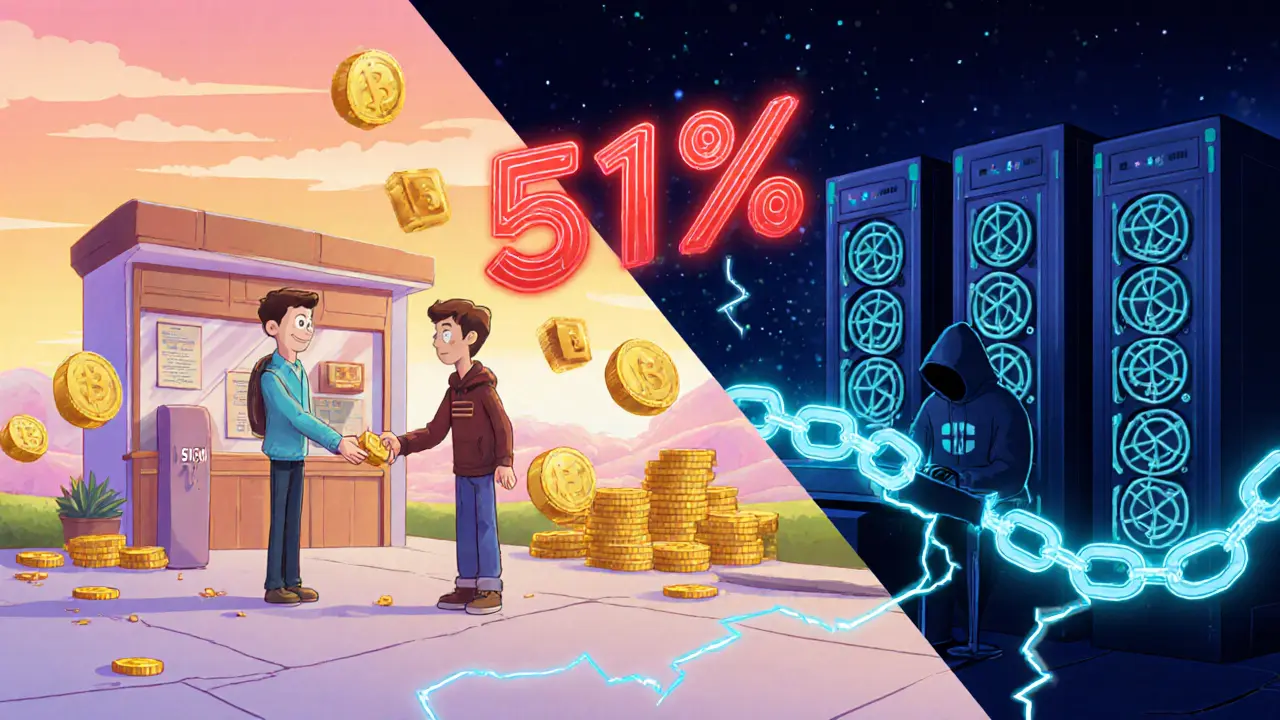

Learn how a 51% attack enables double-spending, see real-world examples, understand why big blockchains are safe, and discover how to detect and prevent these attacks.

Hash Rate: The Engine Behind Crypto Mining

When talking about hash rate, the number of cryptographic calculations a network or miner performs each second. Also called hashpower, it measures raw mining speed and tells you how fast new blocks can be found.

Why hash rate matters today

The Proof‑of‑Work, a consensus method that requires miners to solve hash puzzles leans on hash rate to keep a blockchain honest. Higher hash rate means more computers are working on the puzzle, which raises the cost for anyone trying to rewrite history. At the same time, miners watch Mining Difficulty, the algorithmic target that adjusts every 2016 blocks on Bitcoin to keep block times steady. When hash rate climbs, difficulty rises to prevent blocks from falling too quickly.

Network security is directly tied to this math. A powerful hash rate creates a massive economic barrier: an attacker would need to control over 50% of the total hash power to launch a 51% attack, and the electricity bill alone can outrun any potential gain. This relationship is why many investors keep an eye on hash rate charts when assessing the health of PoW coins.

But hash rate isn’t just about security; it drives real‑world energy consumption. Large mining farms plug in thousands of ASICs or GPUs, pulling gigawatts of power. Regions with cheap electricity, like certain provinces in China before the crackdown or parts of the U.S. and Kazakhstan, attract these farms, shaping local economies and environmental policies. Understanding the link between hash rate and electricity helps regulators weigh the trade‑offs between innovation and sustainability.

From a profitability standpoint, hash rate determines your mining ROI. If you own a mining rig, you compare its hash contribution against the network’s total hash rate. A higher network hash rate dilutes your share of newly minted coins, meaning you’ll need more efficient hardware or lower electricity costs to stay in the black. Tools that track real‑time hash rate help miners decide when to upgrade or shut down equipment.

While PoW relies heavily on hash rate, other consensus models like Practical Byzantine Fault Tolerance (PBFT), a voting‑based algorithm used in permissioned blockchains bypass the need for massive hashing power, focusing instead on validator agreement. This contrast explains why articles about PBFT, digital signature vulnerabilities, and centralized exchange token risks often appear alongside hash‑rate discussions – they all explore how different security mechanisms protect crypto assets. For NFT creators or exchange users, knowing whether a platform runs on PoW or PBFT can affect transaction speed, fees, and even the risk of a 51% attack.

Below you’ll find a curated set of articles that dive deeper into these topics. From the nitty‑gritty of mining economics to the latest security analyses of exchange tokens, each piece builds on the fundamentals of hash rate and its broader impact on the crypto ecosystem.