Dark Knight Swap is a crypto exchange with $36.77 daily volume, zero liquidity, and no security. Avoid it - it's not a legitimate platform, but a high-risk project with no users or future.

Crypto Research and Exchange Reviews from November 2025

When you’re trying to make sense of crypto exchange, a platform where users trade digital assets, often without traditional banking oversight. Also known as decentralized exchange, it can be as safe as a bank or as risky as a gamble with no rules. November 2025 delivered a raw, unfiltered look at what’s actually working—and what’s just noise. From exchanges with $0 trading volume to DeFi protocols that claim to boost yields but have no users, the data doesn’t lie. You won’t find hype here. Just facts: who’s auditing, who’s vanished, and who’s still building.

Behind every shaky exchange is a deeper question: blockchain finality, the point at which a transaction is permanently confirmed and cannot be reversed. Also known as transaction finality, it’s what separates a reliable chain from one that could rewrite history. Posts this month compared Bitcoin’s slow, probabilistic model to Solana’s near-instant deterministic finality—and why it matters when you’re swapping tokens or staking. Then there’s DeFi protocol, a set of smart contracts that automate financial services like lending, borrowing, and trading without intermediaries. Also known as decentralized finance, it’s where LISTA, QUO, and Aperture Finance try to earn your trust. But with liquidity as thin as a paper cut and teams gone silent, most aren’t finance—they’re experiments with token names.

NFT provenance, Web3 development, and micropayments for creators also showed up—not as buzzwords, but as real tools people are trying to use. One post broke down how Ethereum and Solana prove who owns a digital cat NFT, while another showed how a single line of Solidity code can change how a creator gets paid. And then there’s the dark side: fake airdrops for tokens that don’t exist, exchanges with no licenses, and prison myths in Bangladesh that spread like wildfire. This isn’t a list of ‘top picks.’ It’s a map of the minefield.

What you’ll find below isn’t curated for beginners or pros—it’s for anyone who wants to know what’s real before they click ‘invest.’ Whether you’re checking if SwapX’s concentrated liquidity actually works, if Thai exchange rules are as strict as they sound, or if CateCoin is just a meme or something more, every article here cuts through the fluff. No sales pitches. No promises. Just what’s happening, who’s behind it, and whether it’s worth your time—or your crypto.

Dark Knight Swap Crypto Exchange Review: A High-Risk, Low-Liquidity Platform to Avoid

What is Lista DAO (LISTA) Crypto Coin? A Simple Breakdown of Its Features and Why It Matters

Lista DAO (LISTA) is a DeFi protocol on BNB Chain that lets you stake BNB, borrow lisUSD stablecoins, and vote on protocol changes-all in one place. Learn how it works, who it's for, and what risks to watch.

Bit Hotel (BTH) Airdrop Campaign Details: How to Claim BTH Tokens in 2025

Learn how to claim free BTH tokens from Bit Hotel's 2025 airdrops on CoinMarketCap and MEXC. Discover how to use BTH in the retro NFT metaverse and why trading volume is $0.

Understanding Provenance in NFT Collections: How Blockchain Verifies Digital Ownership

NFT provenance is the unchangeable ownership history recorded on blockchain, proving authenticity and value. Learn how minting, smart contracts, and platforms like Ethereum and Solana make digital ownership transparent and secure.

Understanding Wrapped Bitcoin (WBTC): How It Bridges Bitcoin and DeFi

Wrapped Bitcoin (WBTC) lets you use Bitcoin in Ethereum DeFi apps while keeping your BTC. It's backed 1:1, but requires trust in custodians. Learn how it works, who uses it, and whether it's right for you.

What is CateCoin (CATE) Crypto Coin? A Real Breakdown of the Cat-Themed Meme Token

CateCoin (CATE) is a cat-themed memecoin launched in 2021 on BNB Chain with 40 trillion tokens burned. It offers a bet2win game and NFTs but remains highly volatile and unproven. Is it a fun gamble or a risky dead end?

Kwenta Crypto Exchange Review: Decentralized Derivatives Trading on Synthetix

Kwenta is a decentralized derivatives platform that lets you trade synthetic assets like stocks, gold, and forex using crypto collateral. No KYC, no middleman, just on-chain trading on Optimism. Learn how it works, its risks, and who it's really for.

Getting Started with Web3 Development: Your 2025 Roadmap

Learn how to start building Web3 apps in 2025 with Ethereum, Solidity, and real tools. No fluff-just what you need to deploy your first smart contract and avoid common mistakes.

Thai Crypto Exchange Licensing Requirements: What You Need to Know in 2025

Thailand's 2025 crypto exchange licensing rules require $2.1 million upfront, local operations, and strict compliance. Learn the costs, steps, and who's licensed - and why this is one of Asia's toughest crypto frameworks.

Finality Comparison Across Blockchains: Speed, Security, and Real-World Impact

Understanding blockchain finality is crucial for secure transactions. This guide compares probabilistic, deterministic, economic, and Layer 2 finality models across Bitcoin, Ethereum, Solana, and more-helping you choose the right chain for your needs.

EarnBit Crypto Exchange Review: Is the Live Streaming Crypto Platform Worth It?

EarnBit is a crypto exchange with live streaming built in - ideal for traders who want to teach or learn in real time. But with low liquidity, no iOS app, and limited regulation, it's a niche tool, not a replacement for major platforms.

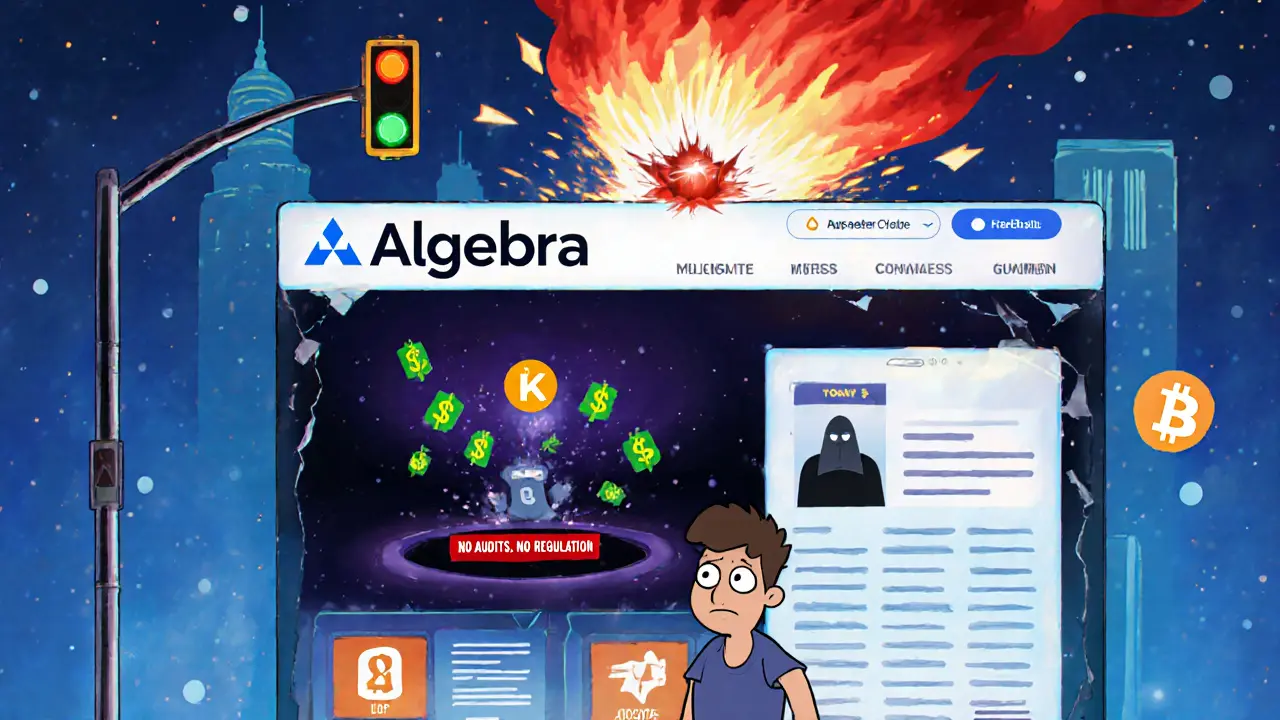

Algebra Crypto Exchange Review: What You Need to Know Before Trading

Algebra crypto exchange lacks transparency, regulation, and security proof. With no audits, no user reviews, and no legal registration, it's too risky to use. Stick to trusted platforms instead.