Understanding blockchain finality is crucial for secure transactions. This guide compares probabilistic, deterministic, economic, and Layer 2 finality models across Bitcoin, Ethereum, Solana, and more-helping you choose the right chain for your needs.

Transaction Finality in Crypto: What It Means and Why It Matters

When you send Bitcoin or swap tokens on a DEX, you want to know it’s done—not just pending, not just confirmed, but truly final. That’s what transaction finality, the point at which a blockchain transaction is irrevocably settled and cannot be altered or reversed. Also known as blockchain finality, it’s the invisible guarantee that your crypto won’t vanish because of a reorg, a 51% attack, or a buggy smart contract. Without it, every trade is a gamble. You might see your balance update, but if finality hasn’t kicked in, the network could still roll back your transaction hours later.

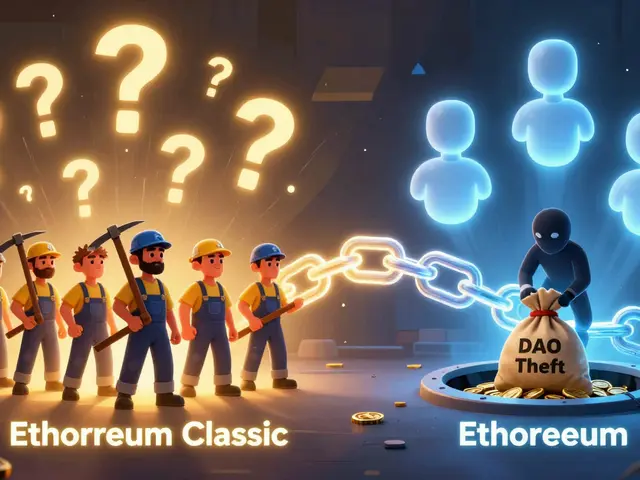

Not all blockchains handle this the same way. Bitcoin uses proof-of-work and waits for six confirmations—roughly an hour—to call a transaction final. Ethereum, after switching to proof-of-stake, achieves finality in under 15 minutes through its Casper protocol, where validators lock in blocks and penalize bad actors. On newer chains like Solana or Optimism, finality can happen in seconds because they use different consensus models optimized for speed. But speed isn’t everything. A chain that finalizes too fast without enough decentralization risks centralization attacks. That’s why some DeFi protocols wait for 100+ confirmations on Ethereum before releasing funds—even if the network says it’s final.

Transaction finality isn’t just about speed or security. It directly affects how you interact with smart contracts, self-executing code on blockchains that automatically trigger actions when conditions are met. Also known as on-chain logic, these contracts rely on finality to know when to release tokens, pay out yields, or lock liquidity. If a DEX like Kwenta or SwapX doesn’t wait for true finality, users could lose funds if a block is reorganized. Same goes for blockchain consensus, the system that lets distributed nodes agree on the state of the ledger. Also known as network agreement, it’s what makes finality possible in the first place. Chains with weak consensus—like those with low validator participation or minimal staking—can’t guarantee finality, even if they claim to.

That’s why you’ll see posts here about exchanges like Block DX and Firebird Finance—some prioritize speed over safety, others bake finality into their design. You’ll also find deep dives into chains like Sonic and Polygon, where finality times vary based on node distribution and economic incentives. And you’ll learn why projects like Quoll Finance or LanaCoin, with near-zero liquidity and no real node activity, can’t offer meaningful finality at all.

Understanding transaction finality isn’t just for developers. It’s the quiet rule behind every trade you make, every airdrop you claim, every wallet you connect. If you don’t know when your crypto is truly yours, you’re trusting the network without knowing how it works. Below, you’ll find real-world breakdowns of how different platforms handle it—what’s fast, what’s safe, and what’s just pretending to be final.